18th Dec 2024. 9.04am

Regency View:

Update

Regency View:

Update

UK retail stores ABF, Next fall on weak Inditex results

Shares in Associated British Foods (ABF), the parent company of Primark, fell last week after disappointing results from Inditex, the Spanish fashion retailer behind brands such as Zara, Massimo Dutti, and Pull&Bear.

Inditex’s performance raised concerns about the health of the global retail sector, particularly in the context of consumer spending. The disappointing results from one of the largest players in the fashion industry sent ripples through the market, resulting in a broader selloff that affected UK retailers, including ABF.

Primark, has continued to show resilience in recent months, delivering solid growth despite the challenging retail environment. However, the decline in ABF’s share price suggests that market sentiment is being influenced by the struggles of larger, international retailers, which raises concerns about consumer behaviour in the UK and beyond.

The market reaction also reflects a broader unease about the potential slowdown in consumer spending, particularly in Europe and the UK. As inflationary pressures persist and economic uncertainty grows, consumers are becoming more selective about their purchases.

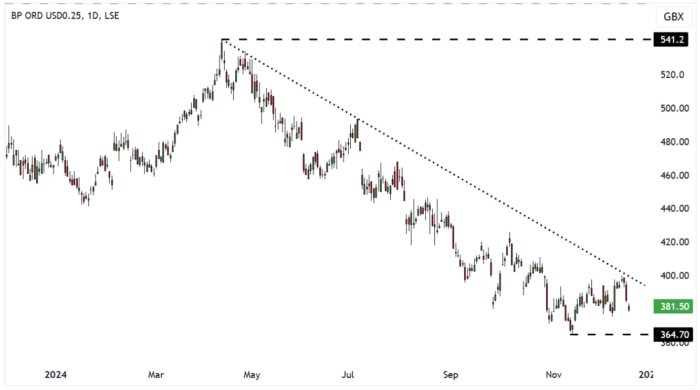

BP scales back renewable goals amid rising costs

BP (BP.) has significantly scaled back its ambitions in renewable power after years of heavy investment…

In 2020, BP set a bold target to increase its green energy spending tenfold to $5bn annually by 2030, with plans to boost its renewable power generation capacity to 50GW by the end of the decade. However, as the energy transition has proven more challenging than expected, BP, like its rival Shell, is re-evaluating its strategy. The company has now placed its offshore wind assets into a joint venture with Japanese partner Jera, reducing its capital expenditure and moving future debt off its balance sheet.

The decision to scale back comes after BP spent $6.8bn on low-carbon power, facing rising costs and a more uncertain political landscape for offshore wind projects. Analysts predict that BP will revise its 50GW renewable capacity target in February, while its green energy budget for next year could also be trimmed. Despite this pullback, BP remains committed to its solar, electric vehicle charging, and power trading businesses, though its offshore wind ambitions have been curtailed.

While BP is attempting to mitigate risks through joint ventures and strategic partnerships, its move shows it may be looking for a way to continue its green transition without overwhelming its balance sheet.

Costain secure HS2 contract win

Costain (COST) has capped off an impressive year with another major contract win, this time from HS2 Ltd.

The company has been awarded a £400m contract to deliver tunnel and lineside mechanical and electrical (M&E) systems for the HS2 project. This new contract, which will begin in Q1 2025, spans a seven-year period with the possibility of extensions.

As the sole supplier for this significant aspect of the HS2 project, Costain will be responsible for the design, supply, manufacture, installation, testing, and commissioning of the M&E systems during the construction phase.

Alex Vaughan, CEO of Costain, expressed pride in the new contract, highlighting the company’s long-standing relationship with HS2 and its pivotal role in the UK’s largest strategic infrastructure project.

This latest win underscores Costain’s ongoing success in securing high-value contracts, reinforcing its position as a leading player in the infrastructure sector. The collaboration with HS2, one of the most ambitious infrastructure projects in Europe, further solidifies Costain’s reputation for delivering complex, large-scale projects. With this contract, Costain continues to demonstrate its ability to secure long-term, strategic partnerships in the UK’s infrastructure landscape.

Volution reports solid start to FY 2025 with positive growth

Volution Group (FAN) has reported a positive start to FY 2025, with revenues for the four months ending 30 November 2024 reaching approximately £123 million, a 1.3% increase compared to the previous year. Organic growth at constant currency was 2.5%.

The group continues to improve its operating margin, driven by operational efficiencies, new product introductions, and cost management initiatives. Free cash flow remained stable, supported by strong trading and focused working capital management.

Revenue performance was strongest in the UK residential market, where Volution’s product solutions continue to gain market share. The company also saw improvements in Continental Europe, with strong performances from ClimaRad in the Netherlands and growth in France.

However, the New Zealand market remains challenging, while Australia showed strong growth. Volution also made progress with its ESG initiatives, notably increasing the use of recycled plastics in production, particularly in the Nordics.

Looking ahead, Volution expects continued growth in both revenue and operating profit for FY 2025, bolstered by positive organic growth momentum and the recent completion of the Fantech acquisition.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.