13th Dec 2024. 10.48am

Weekly Briefing – Friday 13th December

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.05% |

| FTSE 250 | -0.38% |

| FTSE All-Share | +0.01% |

| AIM 100 | -0.67% |

| AIM All-Share | -0.46% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 13th December

Market Overview

Dear Investor,

It’s been a significant week for China, with its policymakers making a dramatic pivot in monetary policy…

The Politburo, China’s top decision-making body, has announced a shift to a “moderately loose” monetary stance for the first time in 14 years.

This change comes as China grapples with softer growth, weakening exports, and ongoing challenges in its property market. By adopting looser monetary policies, the government aims to inject liquidity, lower borrowing costs, and create conditions conducive to recovery.

Financial stocks with significant exposure to China, could see an immediate benefit. Increased liquidity and an improving lending environment could boost their growth, particularly in retail and corporate lending. As property markets stabilise, the demand for mortgages and construction loans may rise, further supporting earnings for financial institutions with regional ties.

Consumer-focused businesses could also gain. Looser monetary conditions and targeted stimulus measures should improve confidence, potentially leading to a rebound in retail sales, credit card spending, and demand for luxury goods. This is especially relevant as China’s affluent middle class continues to expand despite recent economic headwinds.

In the property market, which has been at the centre of China’s economic challenges, the shift in policy could provide much-needed relief. Developers and real estate-related businesses might benefit from lower borrowing costs and increased government support, helping to rebuild confidence and stabilise pricing in a critical sector.

The infrastructure sector is another key area to watch. With a $140 billion (£110 billion) government spending package already underway, sectors such as construction, technology, and heavy machinery are poised to benefit. Companies aligned with China’s infrastructure goals could see strong revenue growth as funds are deployed to revitalise transport and energy networks.

As always, we’ll be watching these developments closely to identify the stocks and sectors best positioned to take advantage of this evolving landscape.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Rockhopper Exploration (LSE:RKH) +24.9% on the week

Rockhopper Exploration has continued to capture attention this week, following a series of positive developments throughout October and November that have reinforced the company’s growth prospects in the North Falkland Basin. The newsflow has sparked interest, with key updates contributing to investor optimism and signalling significant progress in the Sea Lion project, one of Rockhopper’s most important assets.

In October, Rockhopper announced the extension of its North and South Falkland Basin Petroleum Production Licences, securing a clear runway for continued exploration and development activities through to 31 December 2026. This extension was welcomed by the market as it removes near-term regulatory uncertainty and allows the company to maintain its focus on advancing operations in the region.

Then, in November, Rockhopper’s operator, Navitas Petroleum, provided an update on the Sea Lion development, which included a key report from Netherland Sewell & Associates (NSAI). The report showed a 16% increase in oil resources, bringing the total certified 2C oil resources in the North Falkland Basin (NFB) to 917 million barrels.

These updates, paired with the anticipated Final Investment Decision (FID) for mid-2025 and first oil expected by Q4 2027, has given Rockhopper’s strategy momentum.

REGENCY VIEW:

Rockhopper Exploration has been on quite a run, with the shares surging more than 70% this year year. It’s clear that the market is starting to take notice, driven by renewed optimism around their North Falkland Basin interests and some promising licensing news. With a price-to-book ratio of just 0.77x, the stock has a clear value angle, but investors should be under no illusion—this remains a speculative play. Without revenue on the books, success hinges on future milestones, so it’s one for investors who can stomach a bit of risk.

Ashtead’s share price dropped sharply this week after the company released its unaudited half-year and second-quarter results for the period ending 31 October 2024. The group reported a 6% increase in rental revenue for the half-year, but adjusted profit before taxation fell by 4% to $1.26 billion, and earnings per share declined by 5% to 213.6¢. These figures were affected by weaker local commercial construction markets in the U.S., impacted by the ongoing high-interest rate environment.

While large-scale infrastructure projects and hurricane recovery efforts provided some support, they did not offset the decline in other parts of the business. As a result, the company revised its full-year rental revenue growth forecast to 3-5% and indicated that profits for the year would be lower than previously expected.

The company also reported a 2% increase in overall revenue to $5.7 billion, driven by a 5% increase in U.S. rental revenue. However, lower equipment sales, higher depreciation, and increased interest costs contributed to the decline in profitability. Free cash flow improved, with a $420 million inflow compared to a $355 million outflow last year, aided by lower-than-expected capital expenditure.

Ashtead announced a share buyback programme of up to $1.5 billion over the next 18 months and increased its interim dividend to 36¢ per share, up from 15.75¢ last year. The company remains confident in its long-term prospects and continues to invest in its Sunbelt 4.0 strategy, which includes expanding its presence in North America and focusing on customer service and sustainability.

REGENCY VIEW:

Whilst the market has turned cautious on Ashtead’s near-term prospects, the company’s robust operating margins and dependable cash flow generation suggest it’s well-positioned to navigate through challenging conditions.

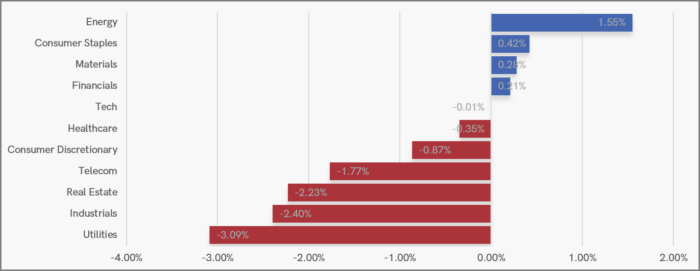

Sector Snapshot

This week has brought a shift in momentum, with Energy and Materials emerging as relative outperformers after weeks of lagging. On the flip side, Utilities faced headwinds from the fallout of storm Darragh, while Industrials took a hit following lacklustre earnings from sector heavyweight Ashtead.

UK Price Action

The FTSE 100 has struggled to break through the critical resistance zone near 8,400, formed by the cluster of swing highs between August and October. Despite testing this level last week and making another attempt on Monday, the index quickly retreated. With the holiday season approaching, the question now is whether a “Santa Claus rally” can generate enough momentum to finally push through resistance.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.