4th Dec 2024. 8.52am

Regency View:

Update:

Regency View:

Update:

Aviva dials up drama in Direct Line takeover bid

Aviva (AV.) have been making the headlines recently after their ambitious bid to acquire Direct Line, a move that has the potential to shake up the UK insurance market. The £13 billion insurance powerhouse made an initial offer of £3.3 billion for Direct Line, which would have created one of the largest players in the motor and home insurance sectors. However, this bold approach was firmly rejected by Direct Line’s board, setting the stage for a dramatic standoff.

Undeterred, Aviva has taken its case directly to Direct Line’s shareholders, hoping to win their support for what it has described as a “highly compelling” proposal. At the heart of this push lies Aviva’s belief that a merger would deliver substantial cost and capital synergies while boosting its presence in the personal insurance market.

But the bid comes at a pivotal moment for Direct Line, which has been navigating its own challenges. The smaller insurer, known for its iconic red telephone mascot, has been grappling with the fallout from a tough motor insurance market and operational setbacks. A new leadership team, largely drawn from Aviva, has been making strides in turning the business around, but Direct Line’s recent struggles have left its share price under pressure—making it a tempting target for acquisition.

With a December 25 deadline for Aviva to either firm up its bid or walk away, and regulatory concerns looming over market concentration, this high-stakes battle is poised to dominate the insurance sector’s headlines through the end of the year.

easyJet sees 34% profit lift

easyJet (EZJ) pushed higher last week following the release of its full-year results for the period ending September 30, 2024. The airline reported a 34% surge in headline profit before tax, reaching £610 million—a £155 million year-on-year increase. This performance was buoyed by another record-breaking summer, reflecting strong demand for both flights and holiday packages. The easyJet holidays division was a standout contributor, with a remarkable 56% increase in profit before tax, climbing to £190 million.

Passenger numbers in the second half grew 7% year-on-year, with load factors maintaining a robust 92%. Despite a slight reduction in revenue per seat on key metrics, the overall group profitability benefited from cost efficiencies, including savings from 16 new A320neo aircraft, which contributed approximately £25 million. The company also recorded a return on capital employed (ROCE) of 16%, up from 13% the previous year, underscoring progress towards its medium-term targets.

The outlook for 2025 appears optimistic. easyJet plans to increase capacity to 103 million seats, with stronger growth in longer leisure routes such as North Africa and the Canary Islands. Meanwhile, easyJet holidays is poised for further expansion, targeting a 25% increase in customer numbers.

Shareholders are also set to benefit, with the company proposing a dividend of 12.1 pence per share, equivalent to 20% of the year’s headline profit after tax. The board emphasized its commitment to maintaining consistent returns, signalling confidence in the airline’s continued growth trajectory.

Outgoing CEO Johan Lundgren praised the results as a testament to the effective execution of easyJet’s strategy and expressed optimism for the future under CFO and CEO designate Kenton Jarvis, who is set to drive further progress towards the company’s ambitious targets.

Halma delivers record revenue and profit growth

Halma (HLMA) topped the FTSE’s leaderboard last month following the release of its half-year results for 2024/25, showcasing record-breaking performance. Revenue exceeded £1 billion for the first time, rising 13% to £1.07 billion, with organic growth contributing 11.5%. Adjusted earnings before interest and tax surged 17% to £222.5 million, driving adjusted earnings per share up by the same margin to 43.01p. The company’s statutory profit before taxation also climbed 16% to £174 million.

CEO Marc Ronchetti emphasised the group’s strong momentum, noting that Halma remains well-positioned to meet its full-year targets, with an adjusted EBIT margin forecast of approximately 21%. This confidence is bolstered by a robust order intake that continues to outpace revenue growth year-over-year.

Halma’s strategy of reinvestment also stood out. The company funnelled £54.1 million into R&D during the period and completed four acquisitions, part of a broader pipeline of seven deals worth £158 million. These efforts support its commitment to innovation and expansion in key markets such as safety, health, and environmental solutions.

With a dividend increase of 7% to 9.00p per share and cash conversion soaring to 108%, Halma further solidified its reputation as a reliable performer. Its net debt-to-EBITDA ratio also improved, underscoring a healthy balance sheet and the ability to fund future growth initiatives.

ITV bounce back on bid battle buzz

There’s been a surge of bid chatter across the UK market recently, with several companies attracting the attention of potential suitors. Last week, ITV (ITV) found itself in the spotlight as reports emerged about growing interest in the broadcaster, particularly its highly profitable ITV Studios production arm.

Private equity firm CVC Capital Partners, along with France’s Groupe TF1, are among those reportedly exploring bids for ITV. Other industry players, such as RedBird Capital and Mediawan, are also said to be considering offers, further adding fuel to the fire.

This renewed focus on ITV’s assets, especially its studios, comes at a time when other media companies, like RedBird Capital, have shown a strong appetite for content production. RedBird’s £1.2 billion acquisition of All3Media has led some analysts to believe that ITV’s studios could be undervalued. While ITV’s core broadcasting business continues to face challenges in the competitive streaming landscape, its content creation division is increasingly drawing the attention of potential acquirers, which has intensified takeover speculation.

The buzz around ITV’s potential sale comes as a welcome relief following its disappointing Q3 results in November. While it’s still early days, the current situation presents an interesting opportunity, and for now, we recommend staying tuned and watching closely as this story unfolds.

Kingfisher’s Q3 trading update falls flat

Kingfisher’s (KGF) Q3 trading update, covering the period to October 31, 2024, failed to impress, with reported sales down 0.6% and like-for-like (LFL) sales declining 1.1%.

While the company managed to stay in line with or ahead of market expectations for its key banners, the overall performance was weighed down by challenges in certain regions. Sales growth in the UK & Ireland, particularly from Screwfix and TradePoint, was overshadowed by a weak consumer environment in France and slower market conditions in Poland.

Notably, the company’s largest market, France, saw a significant drop in sales due to poor consumer sentiment and unfavourable weather in October, while Poland’s market share gains weren’t enough to offset a slight dip in sales.

Despite solid trading in August and September, driven by repairs and home renovation activity, the more challenging October market dynamics reflected the wider uncertainty across Europe, partly influenced by concerns over government budgets in both the UK and France. The big-ticket categories, which make up a significant portion of Kingfisher’s sales, were particularly soft, with LFL sales declining by 4%. This was in line with the broader consumer sentiment trends that have seen discretionary spending squeezed, particularly in more expensive categories. Seasonal sales were also impacted, as milder weather in key markets in October led to weaker demand for outdoor and heating products.

On a more positive note, the company did see some improvements in e-commerce and trade sales, particularly in its Screwfix and B&Q banners, which benefitted from strong market share gains and solid growth in e-commerce transactions. However, the overall profit guidance range for the full year has been tightened to between £510 million and £540 million, a slight downward revision from the previous guidance of £510 million to £550 million.

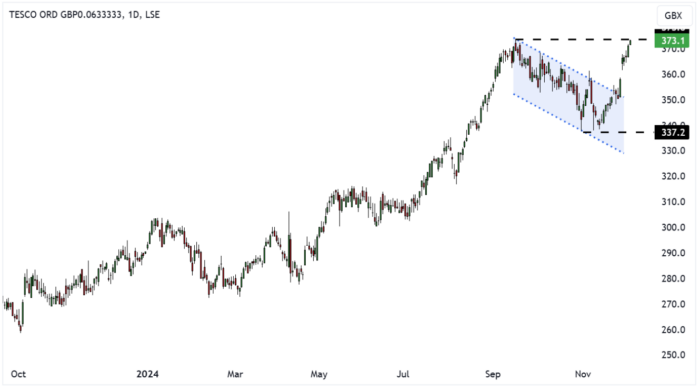

Tesco break higher on CMA loyalty scheme boost

Tesco’s (TSCO) share price broke higher last week following the release of a key update from the UK’s Competition and Markets Authority (CMA), which concluded that supermarket loyalty schemes, including Tesco’s Clubcard Prices, offer genuine savings to customers.

This announcement has provided a significant boost to investor sentiment, particularly given the increasing importance of loyalty programmes in driving customer retention and sales growth for Tesco.

The CMA’s findings, based on an analysis of 50,000 grocery products, revealed that loyalty schemes are providing consumers with real savings, ranging from 17% to 25% off the usual price of promoted items. Tesco, with its market-leading Clubcard Prices initiative, was one of the schemes under review, and the positive outcome reassures both shoppers and investors that the supermarket giant is maintaining fair pricing strategies while staying competitive.

This is a crucial development for Tesco, as loyalty schemes have become a central pillar of its strategy to engage shoppers and boost footfall. The announcement comes at a time when Tesco is already riding high on a solid financial performance, with the company’s revenue and profits showing resilience despite broader inflationary pressures on the cost of living. Furthermore, Tesco’s strong free cash flow generation and the ongoing expansion of its Clubcard Prices programme offer a solid foundation for continued growth, making the breakout from its recent consolidation phase all the more significant.

With the technical picture also looking more favourable, as Tesco’s share price broke above its previous resistance level and the descending channel it had been stuck in for several weeks, investors are now looking to the festive period with renewed optimism for the stock.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.