27th Nov 2024. 9.03am

Regency View:

BUY DCC (DCC)

- Growth

- Value

- Income

Regency View:

BUY DCC (DCC)

DCC rises above: Earnings season’s standout winner with strategic overhaul

As earnings season fades into the rearview mirror, it’s the perfect time to refocus and align with the standout performers.

One such success story is DCC, a FTSE 100 heavyweight whose daring strategic pivot has sparked renewed interest in its shares.

Let’s explore what makes DCC stand out and why it has quickly captured the attention of institutional investors.

DCC’s strategic overhaul: A bold move to sharpen focus

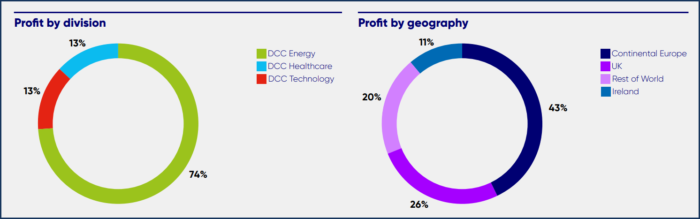

DCC has built its reputation on diversification, operating across energy, healthcare, and technology. Historically, this multi-sector approach helped it navigate market turbulence while delivering steady earnings growth. However, diversification often comes with challenges—particularly in unlocking value. Recognizing this, DCC announced a strategic review that fundamentally redefines its focus.

The headline decision? A pivot toward its energy division, which already accounts for 70% of group revenue and remains its most profitable segment. This includes plans to divest its healthcare unit and assess options for its technology business, streamlining its portfolio to capitalise on the global energy transition.

This move was met with widespread approval. Analysts hailed it as timely, given surging demand for sustainable energy solutions. Investors responded in kind, with the shares jumping 9% on the day of the announcement, their biggest single-day gain in over a year. The market clearly sees DCC as a more focused and agile company, better positioned to capture the long-term growth opportunities in energy markets.

The chart awakens: Technical breakout signals bullish momentum

For much of 2024, DCC’s share price had been stuck in neutral. The shares oscillated within a 10% range, frustrating both traders and long-term holders. This sideways drift turned into a slow decline during the autumn, with the shares hitting a lows of £49 earlier this month.

However, the strategic review acted as a game-changer. DCC’s shares gapped higher following the announcement, reclaiming critical levels such as the 200-day moving average for the first time since July. The breakout wasn’t just a technical milestone; it marked a shift in market sentiment, with institutional buyers stepping in to price in the long-term benefits of the strategic overhaul.

With shares now consolidating their recent gains near £56, we expect the burst of bullish momentum created by the price gap to reverberate through the share price for some time to come.

Valuation: Quality at a discount

DCC is not just a momentum play; it’s a fundamentally solid business trading at a compelling valuation. With a forward P/E ratio of 11.2, the stock is trading at a significant discount to the broader FTSE 100, which averages around 13.8. Its EV/EBITDA multiple of 7.91 further underscores its relative value.

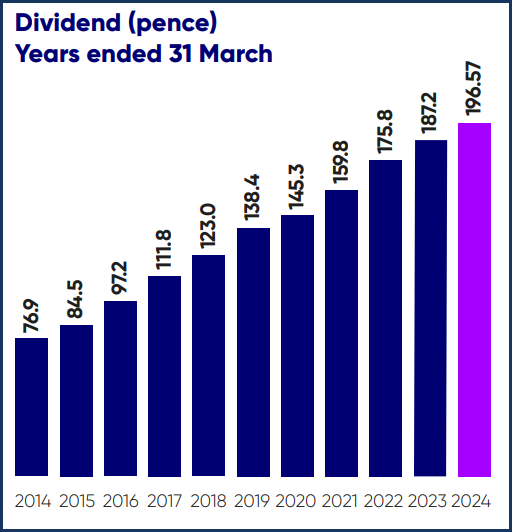

The company’s financials are equally robust. Free cash flow came in at £470 million over the past year, supporting a 3.79% dividend yield. With a payout ratio below 50%, DCC has ample room to maintain or grow its dividend, appealing to income-focused investors. Additionally, its 9% return on capital employed (ROCE) highlights its efficiency in deploying shareholder funds, outpacing many peers in the industrials sector.

The strategic pivot toward energy also enhances DCC’s long-term growth prospects. The division already benefits from high-margin activities like LPG distribution, and the global push toward energy sustainability adds a tailwind. Analysts now forecast annual earnings growth of 8-10% over the next three years, a marked improvement from the 5% average seen over the past five.

Why we’re adding DCC to our FTSE Investor list

DCC’s combination of strategic clarity, financial strength, and technical momentum makes it an excellent addition to our list of FTSE leaders. The strategic review has unlocked fresh growth potential, and the market reaction suggests we’re not the only ones taking notice.

With shares consolidating above critical support levels and a valuation that remains attractive relative to peers, DCC offers a rare blend of quality, value, and momentum. As institutional buying continues to price in the benefits of its energy focus, we see significant upside potential in the months ahead.

For investors seeking long-term growth with a reliable dividend, DCC stands out as one of the clear winners of this earnings season.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.