1st Nov 2024. 10.09am

Weekly Briefing – Friday 1st November

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.25% |

| FTSE 250 | -2.08% |

| FTSE All-Share | -1.28% |

| AIM 100 | +1.92% |

| AIM All-Share | +1.93% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 1st November

Market Overview

Dear Investor,

The market’s response to Rachel Reeves’ first UK Budget was a classic example of cautious optimism meeting fiscal reality. Investors came in with low expectations thanks to weeks of budget leaks, and while some sectors faced increased tax pressure, the final announcements proved gentler than expected for most.

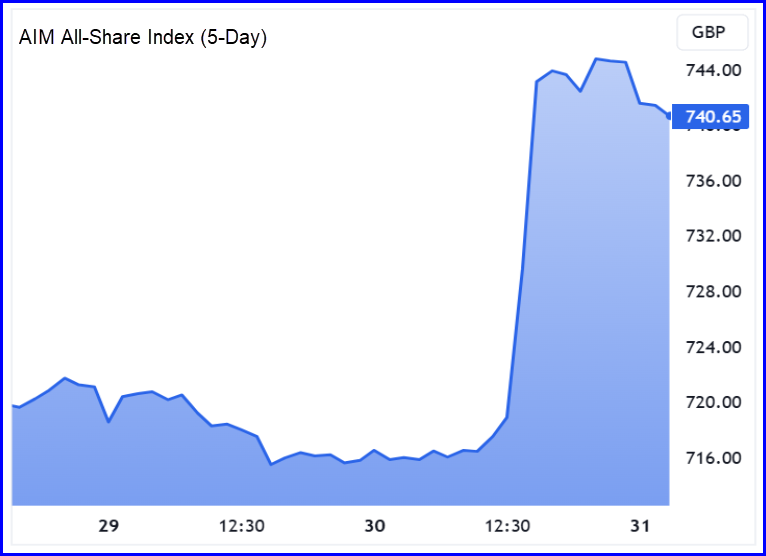

The FTSE 100, with its global mix of mega-caps, stayed relatively unfazed, nudging down slightly as it responded more to the international economic mood than domestic policy changes. Meanwhile, the FTSE 250 and AIM—where UK-focused firms dominate—took the opportunity to shine. Medium-sized firms found favour as budget measures turned out to be less punishing than feared, and the AIM All-Share index had its best day since 2020 thanks to the decision to halve, rather than abolish, inheritance tax relief on AIM-listed shares.

One of the clearest winners? Gambling stocks. Shares in companies like Entain and Flutter shot up, free from the looming spectre of new levies. They’re riding high for now, as investors took a big sigh of relief following the Chancellor’s silence on fresh taxes in the sector. Housebuilders also celebrated initially, buoyed by promises of substantial investment in affordable housing. By Wednesday’s close, though, the early gains had mellowed, showing that the sector may need more than promises to sustain real momentum.

The oil and gas sector faced a different story, with the windfall tax rising to 38% and extended until 2030. BP took a minor hit, while Shell closed the day marginally higher, showing that even with new taxes, these giants remain well-cushioned. Airlines fared similarly, mostly shrugging off tax hikes on air passenger duty.

The bond market, however, told a story all its own. Gilt yields whipsawed as investors worked to digest a mixed bag of long-term borrowing implications, ending Wednesday higher and slightly dialling down hopes of an imminent rate cut.

Looking ahead, UK equities aren’t just navigating domestic policies and higher taxes; the upcoming US election between Donald Trump and Kamala Harris will also cast a significant shadow on global markets. With trade policies, regulatory changes, and economic strategies likely to shift under either administration, the election outcome could ripple through sectors from finance to tech. For UK investors, the key question is whether the results will add more momentum or more caution to the markets—and just how global sentiment will shape up as these economic powerhouses set their courses.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Tracsis (AIM:TRCS) +19.6% on the week

Tracsis, known for its expertise in rail infrastructure and data analysis, experienced a boost in its share prices following the Autumn Budget announcement.

Chancellor Rachel Reeves’ speech introduced ambitious rail investments, including the electrification of key routes and substantial upgrades aimed at enhancing connectivity across the North of England.

These initiatives place Tracsis in a favourable position to support and benefit from the upcoming projects, as its technologies are essential for ensuring efficient rail operations, data-driven maintenance, and streamlined asset management—all areas emphasised in the new spending plans.

The Budget’s commitment to advancing the Trans-Pennine Route Upgrade, including electrification between key northern cities like Manchester, Leeds, and York, presents significant business opportunities for Tracsis.

These upgrades not only require the sort of technological support that Tracsis provides, but they also signal a steady pipeline of government-backed projects that could fuel revenue growth over the coming years. By securing its role in these long-term plans, Tracsis is viewed by investors as a critical player in the government’s broader strategy to modernize the UK’s rail network, making it an attractive prospect in the transportation infrastructure sector.

Additionally, investments like the East-West Rail project and HS2 tunnelling work bolster investor confidence that the government is committed to long-term rail improvement, setting the stage for Tracsis to deepen its involvement in both national and regional initiatives.

REGENCY VIEW:

Tracsis is currently trading at a forward PE ratio of 16.3, which seems reasonably priced given its projected EPS growth of 43.2%, PEG ratio of 0.5, and robust cash position; this suggests potential for undervaluation, particularly as the company stands to benefit from new government investments in rail infrastructure.

Close Brothers’ shares continued to slide this week after last Friday’s Court of Appeal ruling, which cast uncertainty over its motor finance division.

The court found that motor dealers, when acting as credit brokers, hold a fiduciary duty to their customers, a decision that effectively mandates them to provide advice that prioritizes customer interests in financial matters. This ruling could have significant repercussions for Close Brothers, as it opens the door to similar claims and potential liabilities.

In response, Close Brothers has temporarily halted new UK motor finance business, allowing time to review its documentation and processes for compliance. The company stated that while the financial impact of this particular case isn’t material to the group, the decision might set a precedent. If it does, this could lead to further claims, potentially creating sizable financial obligations. The stock has faced ongoing pressure as investors weigh the risks, with uncertainties around how many claims could emerge and the likely cost and timeline for resolution.

Close Brothers, which maintains a strong CET1 capital ratio of 12.8%, aims to appeal the decision to the UK Supreme Court. While this may extend the uncertainty, the bank emphasized its commitment to supporting customers and safeguarding its business reputation.

REGENCY VIEW:

Close Brothers appears significantly undervalued, with a forward P/E of just 3.1, yet the recent court ruling has deepened market skepticism, especially in the short term. While the company’s low price-to-book ratio (0.19) suggests potential value, declining momentum and uncertain legal liabilities make it a speculative play until clearer guidance on the financial impact of ongoing claims emerges.

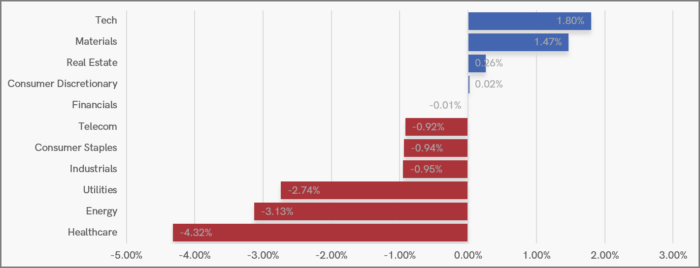

Sector Snapshot

Tech stocks are leading the market this week with impressive gains from some key holdings across our FTSE Investor and AIM Investor products, including Softcat, Eckoh, and Beeks Financial Cloud.

While Healthcare stocks are lagging the market due to losses in Pharma stocks. Utilities and Energy are also showing relative weakness this week.

UK Price Action

The FTSE 100 has faced a challenging week, breaking and closing below its September lows, signalling ongoing bearish sentiment. Currently, the index is retesting its 200-day moving average—a key indicator closely monitored by both investors and traders. Given its upward slope, this long-term moving average could act as a vital support level in the days ahead.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.