18th Sep 2024. 9.01am

Regency View:

BUY Balfour Beatty (BBY)

- Value

Regency View:

BUY Balfour Beatty (BBY)

Why we’re bullish on Balfour Beatty

The UK construction sector has been on a tear over the past three months, rallying more than 14%, driven by a surge in optimism following the new Labour government’s infrastructure push.

Leading the charge in this sector is infrastructure giant Balfour Beatty. With impressive financial results, shares trading at a discount to their intrinsic value, and a technical setup suggesting strong momentum, Balfour Beatty looks poised for a strong finish to the year.

Half-year results: More than just a sparkler

August’s half-year results came off the back of a blockbuster set of earnings reported in March. The market, always quick to look ahead, greeted August’s numbers with the enthusiasm of a damp firework. However, a closer look reveals the underlying strength of Balfour Beatty’s performance.

The Group achieved a 2.3% operating margin in its UK Construction division, up from 2.0% in the same period last year. This improvement signals effective cost management and operational efficiency, setting a solid foundation for future growth.

The total cash position at the half-year stood at £785 million, slightly down from £842 million at the end of 2023. Despite this decrease, the liquidity remains robust, offering a strong buffer for ongoing investments and strategic initiatives. Operating cash flows were £120 million, surpassing profit from operations of £105 million, showcasing strong cash generation despite a £72 million outflow related to the multi-year share buyback program.

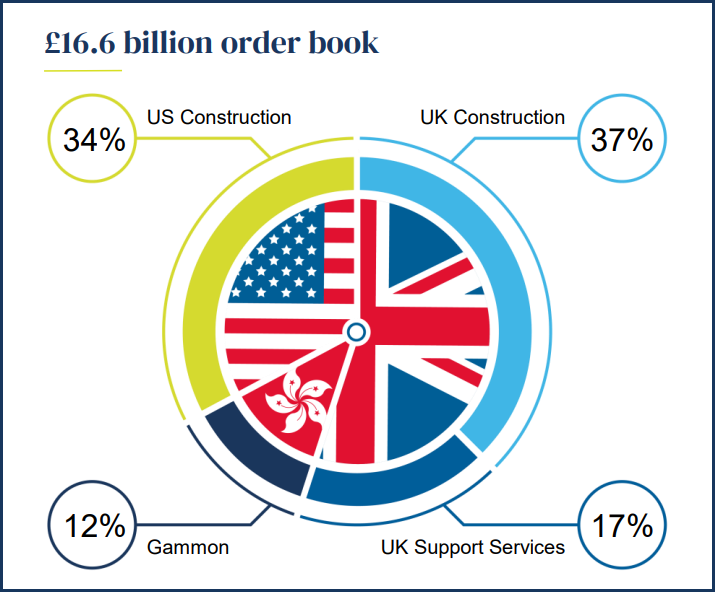

Revenue in the first half of 2024 was £3.2 billion, compared to £2.9 billion in the first half of 2023, reflecting growth in project completions and successful contract wins. The Group’s order book reached £16.6 billion, bolstered by new project awards and ongoing work on major infrastructure projects.

Major contract wins: Power moves and strategic gains

Balfour Beatty’s recent string of contract wins highlights its commanding presence in the infrastructure arena. One of the most notable is a £363 million contract with the National Grid, aimed at extending high voltage electricity cables across 29 kilometers from Essex to Suffolk. This impressive project not only demonstrates Balfour Beatty’s capability to tackle large-scale energy infrastructure but also underscores the growing momentum in the electricity sector.

The contract is set to enhance the UK’s power grid, showcasing Balfour Beatty’s role in advancing critical infrastructure. This win aligns perfectly with the company’s strategy to capitalise on opportunities in the energy transition space. It’s a testament to the company’s strong market position and its ability to secure and execute high-profile projects.

Additionally, the £185 million contract for upgrading the A9 road in Scotland and the £250 million expansion project for Rolls-Royce in Derby further illustrate Balfour Beatty’s versatility and strategic focus. Whether it’s enhancing transport infrastructure or supporting defence sector growth, these wins reflect Balfour Beatty’s ability to deliver on complex and high-value contracts.

45% undervalued: A deep discount

Let’s talk numbers—specifically, the fact that Balfour Beatty’s shares are currently trading at a striking 45% below our estimated fair value of £7.73. Whilst fair value is theoretical, the discount is deep enough to catch our attention.

At a price-to-earnings (PE) ratio of 7.5, Balfour Beatty is significantly undervalued compared to the industry average of around 11.5. On top of that, the company offers a dividend yield of 5.2%, which is much higher than the market average—perfect for those who appreciate a steady income stream along with their investment.

Looking ahead, the anticipated 15% growth in earnings per share (EPS) for the next year adds more weight to the argument. This expected growth reflects a robust pipeline and solid operational performance, hinting that the stock is due for a significant re-rating as both market conditions and company performance come into alignment.

Technical timing: Setting the stage for a breakout

Balfour Beatty’s share price has been on a steady climb since the beginning of the year, consistently trading above its 50-day moving average, which is comfortably elevated above the rising 200-day moving average.

Lately, the stock has formed a symmetrical triangle pattern, marked by a series of lower swing highs and higher swing lows. This classic chart formation often indicates a period of consolidation before a potential breakout. Given the ongoing upward trend, this pattern suggests that Balfour Beatty is gearing up for a breakout that aligns with the broader market momentum. Positioning ourselves within this triangle could enhance short-term risk/reward dynamics of our entry.

In summary, with the technical catalyst in place, attractive valuation and strong financials, Balfour Beatty is a standout choice for our FTSE Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.