16th Aug 2024. 10.32am

Weekly Briefing – Friday 16th August

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.98% |

| FTSE 250 | +0.47% |

| FTSE All-Share | +2.02% |

| AIM 100 | +1.05% |

| AIM All-Share | +0.90% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 16th August

Market Overview

Dear Investor,

This week, the UK economy has been under the spotlight, with a flood of key data giving us a clearer — but not necessarily simpler — picture of where things stand. As we wrap up the week, it’s evident that the UK is walking a tightrope between resilience and uncertainty, with market reactions echoing this delicate balance.

On Tuesday, the big news was the slowdown in wage growth, which dipped to 5.4% in the three months to June, its lowest in nearly two years. While this might sound like a relief for the Bank of England, as it eases some inflationary pressure, it also raises a red flag about consumer spending. Coupled with a surprising drop in the unemployment rate to 4.2%, the data painted a contradictory picture of the labour market—one that’s both cooling and tightening, depending on which numbers you believe.

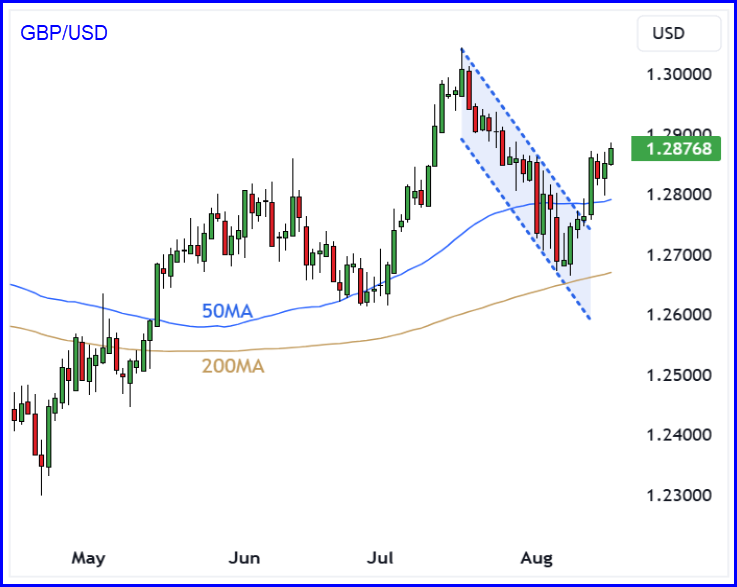

Tuesday’s data triggered a breakout in the British pound, with GBP/USD shooting up to hit two-week highs. The pair broke above a descending channel that had held it in check since mid-July, signalling renewed investor confidence in the UK’s economic prospects, at least for the time being.

Wednesday brought another twist with inflation data coming in at 2.2% for July—lower than expected but still above the BoE’s 2% target. This slight uptick, coupled with a sharper-than-anticipated drop in services inflation to 5.2%, puts the BoE in a bit of a bind. Do they cut rates to keep the recovery going, or hold firm to ensure inflation is truly under control? It’s a delicate dance, and the central bank seems in no rush to make any sudden moves, despite having already made its first rate cut since the pandemic earlier this month.

And then, Thursday’s GDP figures landed, showing the UK economy grew by 0.6% in Q2—a slight deceleration from Q1’s 0.7% but still solid given the global economic headwinds. This growth, driven by household spending and a resilient service sector, suggests that while the UK economy is facing its fair share of challenges, it’s far from out of steam.

So, where does this leave us? Well, the UK economy is sending out mixed signals—some encouraging, others cautionary. The slowdown in wage growth and inflation might give the BoE a bit of breathing room, but with ongoing labour market uncertainties and only moderate GDP growth, it’s clear that we’re not out of the woods yet. The BoE’s next steps will be crucial, and they’ll likely continue their careful balancing act, trying to support growth without letting inflation slip out of control again.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Admiral Group (LSE:ADM) +12.7% on the week

Insurer Admiral surged higher this week after reporting impressive interim results that beat analyst forecasts. Admiral’s pre-tax profits soared by 33% to £310 million, surpassing the consensus estimate of £304 million. This surge in profits was fuelled by a significant 12% increase in its customer base, which reached 10.5 million by the end of June.

The insurer’s strong performance was largely attributed to its success in capitalising on favourable underwriting conditions within its key UK motor division. Admiral’s strategic decision to cut motor insurance premiums at the beginning of the year helped attract new customers, boosting its vehicle coverage to a record 5.5 million. As a result, turnover from its motor insurance division surged by nearly 60% to £2.4 billion.

Additionally, Admiral’s improved motor combined ratio—a key indicator of underwriting profitability—fell to 73.8% from 82.3% in the same period last year, reflecting better management of claims and expenses. The company also declared an interim dividend of 71p per share, exceeding analysts’ forecast of 67.3p, further enhancing investor sentiment.

Chief Executive Milena Mondini de Focatiis noted that Admiral had acted early in reducing prices compared to its peers, contributing to its competitive edge. While industry-wide motor insurance prices had surged in recent years due to rising costs, there are signs of a reversal in this trend. Admiral’s positive results and guidance on slowing claims inflation were seen as a hopeful signal for the broader insurance sector.

REGENCY VIEW:

Admiral Group is riding high with impressive revenue and EPS growth, showcasing its operational strength and profitability. However, with its lofty valuation and hefty gearing, there’s a bit of a balancing act ahead. It’s a solid performer, but keep an eye on how it manages its debt and dividends going forward.

Crest Nicholson’s share price dropped sharply on Tuesday after Bellway decided to withdraw its takeover bid. The move came as a significant blow to Crest Nicholson, whose shares plummeted following the announcement.

Bellway had previously shown strong interest in acquiring Crest Nicholson, initially proposing a takeover offer valued at £720 million. The two companies were nearing a deal, with Crest Nicholson’s board indicating it was inclined to recommend Bellway’s sweetened offer. However, Bellway requested additional time to complete its due diligence, which extended the decision deadline to August 20. On Tuesday, Bellway announced it would not proceed with a firm offer, citing its need to reassess the situation.

This development exacerbates Crest Nicholson’s struggles, which have been compounded by a series of profit warnings, safety issues, and higher costs related to remediation of legacy sites. The company has also faced challenges from a downturn in new home sales driven by rising mortgage rates, which has affected the broader housing sector.

REGENCY VIEW:

Crest Nicholson’s financials highlight a company under pressure, with declining revenue, negative margins, and signs of distress. While it’s undervalued, the challenges ahead make it a risky investment.

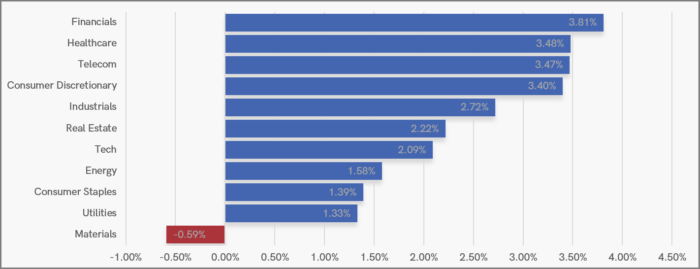

Sector Snapshot

It’s a sea of blue this week with one notable exception – Materials, or to be more specific, Metals & Mining. The reason for the weakness was a combination of underwhelming earnings and signs of diminishing demand from China. Iron ore futures hit their lowest in more than a year this week as disappointing credit data from China worsened market sentiment.

In terms of strength, there is a relatively broad base with Financials leading the pack after a strong showing during summer earnings season.

UK Price Action

The FTSE 100 index has bounced back with a vengeance, erasing last week’s setbacks and finding solid ground at the VWAP anchored to the January lows—an important level that also aligns with the 200-day moving average. This resurgence indicates that short-term momentum is back in sync with the longer-term uptrend. With the index now climbing above its 50-day moving average, it looks like the market is getting back on track and setting a positive tone for the near future.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.