15th Aug 2024. 9.00am

Regency View:

BUY Celebrus Technologies (CLBS)

Regency View:

BUY Celebrus Technologies (CLBS)

Celebrus Technologies: Capitalising on the big data boom

The growing importance of ‘big data’ has been a core investment theme for AIM Investor since we started the service in 2019.

This sector is particularly well-suited to small, fast-growing businesses that can generate high levels of recurring revenue and achieve scale rapidly. High among these exciting businesses is Celebrus Technologies (CLBS), a company that has refined its software as a service (SaaS) to generate impressive financials.

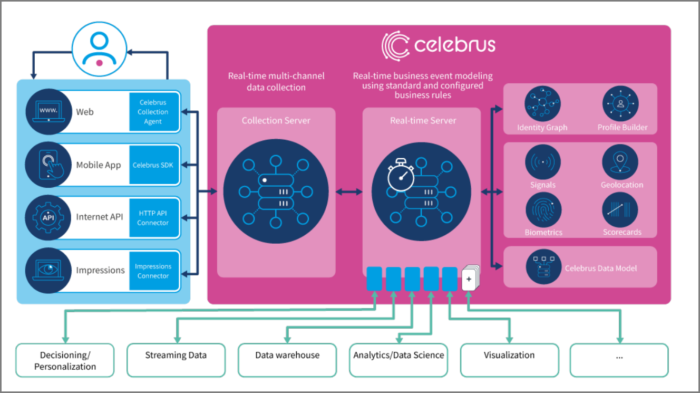

Integrating AI and advanced behavioural biometrics

Celebrus stands at the forefront of data innovation by seamlessly integrating AI with advanced behavioral biometrics. This combination enables Celebrus to offer exceptionally precise and secure data solutions.

Their AI algorithms go beyond simple data analysis, continuously learning and adapting to detect emerging patterns and trends in consumer behaviour. This dynamic capability allows businesses to create highly personalised marketing strategies and improve customer engagement.

Complementing this, Celebrus employs advanced behavioural biometrics, which analyse unique user interactions such as typing rhythm and mouse movements. This sophisticated approach enhances security by detecting unusual patterns that may indicate fraudulent activity or unauthorized access.

Celebrus’ powerful combination of AI and behavioural biometrics provide businesses with deeper insights and stronger protection, ensuring they can effectively engage customers while safeguarding their data.

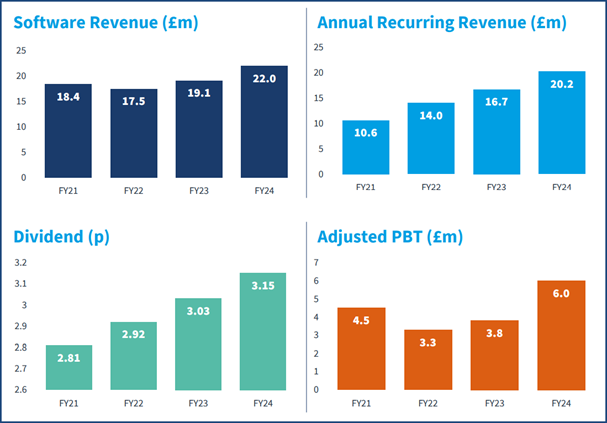

Strong ARR growth and improved profitability

Celebrus has demonstrated impressive financial resilience and growth, particularly in its Annual Recurring Revenue (ARR) and profitability metrics. Over the past year, the company has achieved a notable 20% increase in ARR, reaching £20.2 million. This growth reflects not only the expansion of their customer base but also the increasing demand for their data solutions in the market.

The company’s software segment has been the standout performer, with revenue surging by 92% year-on-year. This sharp increase highlights Celebrus’s successful transition to a high-margin software model, which has become the backbone of its business. The shift has driven substantial improvements in profitability, with operating profit nearly doubling from £2.05 million to £4.99 million.

Vertical market wins drive growth

Celebrus’s focus on vertical markets has proven highly effective, as demonstrated by their recent contract wins.

The company recently secured a significant three-year agreement with a major global airline. This contract, valued at approximately £0.7 million in ARR, will enhance the airline’s digital booking process across all platforms. The integration of Celebrus’s data solutions is set to provide a more seamless and insightful booking experience, which is crucial in the competitive travel sector.

In addition, Celebrus achieved an upsell with an existing airline client, expanding their Celebrus platform to include real-time cross-brand personalization and mobile data capabilities. This upgrade, aimed at improving customer loyalty, showcases Celebrus’s ability to deepen client relationships and deliver enhanced value.

Quality and growth

When selecting AIM stocks, our investment philosophy prioritises financial quality. We believe that small caps, with their inherent risks and potential for high returns, offer a more favourable risk-reward profile when filtered for strong financial fundamentals. In this context, Celebrus stands out as a prime example of a high-quality growth stock.

Celebrus has impressive financial quality across several key metrics. The company’s robust operating margin of 15.3% and a return on capital of 16.2% reflect its effective cost management and operational efficiency.

The company’s financial health is further evidenced by its strong cash position of £30.7 million and its debt-free balance sheet. This provides Celebrus with the flexibility to invest in growth opportunities and weather economic uncertainties without the strain of financial leverage.

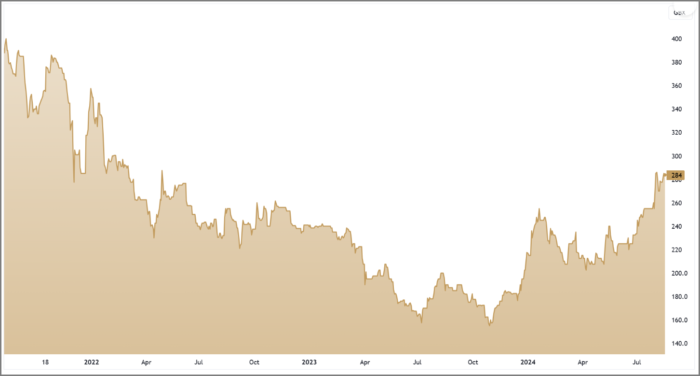

On its price chart, Celebrus have clear momentum. The shares have carved out a powerful uptrend fuelled by a series of bullish trading updates. On a year-to-date basis, the stock has comfortably outperformed the wider market, and after a period of sideways consolidation from March-June, the 50-day moving average (MA) is once again accelerating above the 200MA.

The combination of solid financial quality and robust growth prospects positions Celebrus as a standout investment in the SaaS market, aligning with our emphasis on selecting high-quality small caps that offer both stability and significant upside potential.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.