9th Aug 2024. 10.27am

Weekly Briefing – Friday 9th August

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.29% |

| FTSE 250 | -0.59% |

| FTSE All-Share | +0.13% |

| AIM 100 | -0.02% |

| AIM All-Share | -0.33% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 9th August

Market Overview

Dear Investor,

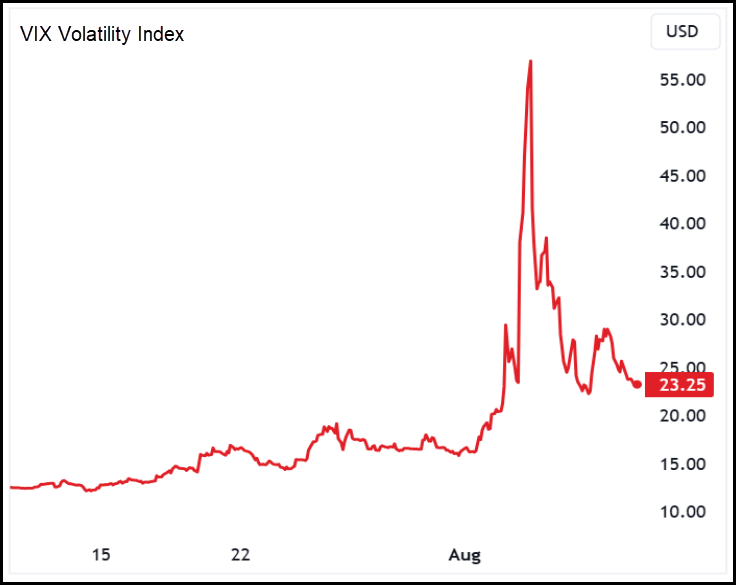

After a sleepy start to the summer, volatility has returned to global markets in a big way during the last seven sessions. On Monday, Wall Street’s “fear gauge,” the VIX volatility index, surged to levels not seen since October 2020, underscoring the intensity of the market’s unease as global stocks dropped sharply.

As we approach the end of this manic week, it’s important to step back and try to make sense of it all—understanding the factors driving this renewed volatility and what it might mean for the road ahead.

The recent spike in market volatility is the result of several intertwined factors. First and foremost, economic data released over the past week has sparked renewed fears about the health of the global economy. In the US, a weaker-than-expected jobs report revealed a significant slowdown in hiring, raising concerns that the world’s largest economy might be losing momentum under the strain of high interest rates. This has led to growing anxiety that the Federal Reserve may have waited too long to begin cutting rates, increasing the risk of a recession.

These fears are not limited to the US alone. In Europe, economic indicators have also pointed to weakening growth, exacerbated by ongoing geopolitical tensions and a decline in consumer confidence. Meanwhile, China, the engine of global growth, has shown signs of slowing, particularly in its manufacturing sector, which has struggled in recent months.

The sell-off has been exacerbated by significant movements in the currency markets, particularly in Japan. The Bank of Japan’s unexpected decision to raise interest rates last week led to a rapid rise in the yen, putting pressure on Japan’s export-driven economy. This move triggered a sharp sell-off in Japanese stocks, with the Topix index experiencing its worst drop since the 1987 “Black Monday” crash.

Compounding these issues is the fact that we are currently in a period of traditionally low market liquidity, as many traders and investors are away for the summer. This reduced liquidity can amplify market moves, making the recent volatility even more pronounced and unpredictable. Whether this is just a summer storm or the beginning of a deeper sell-off will become clearer when liquidity returns in September.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Deliveroo (LSE:ROO) +17.9% on the week

Shares in food delivery company, Deliveroo jumped higher this week following the release of its positive interim financial results for the first half of 2024.

Deliveroo reported significant progress in its financial performance, including a return to profitability and positive free cash flow, which boosted investor confidence.

The results showed a 57% increase in adjusted EBITDA to £62 million, alongside a profit of £1 million for the period, a stark contrast to the £83 million loss reported in the same period last year.

Additionally, Deliveroo announced a £150 million share buyback program, which further fuelled the surge in its share price. This move reflected the company’s strong cash position and management’s confidence in its future outlook.

The market responded positively to the news, with shares climbing as investors anticipated continued growth and profitability improvements, driven by the company’s focus on expanding its grocery and retail offerings.

REGENCY VIEW:

Deliveroo has surprisingly strong financials and boasts a rock-solid balance sheet. However, the stock trades on an eye-wateringly high forward PE multiple of 40 which makes the stock vulnerable to missing the market’s lofty growth estimates.

Rightmove’s stock dropped on Tuesday after the company announced that its contract with OpenRent, an online lettings agent, will terminate effective September 1st, 2024.

The termination raised concerns among investors, particularly because OpenRent represents approximately 700 branch equivalents and accounted for nearly 8% of Rightmove’s lettings listings as of July 2024.

While Rightmove reaffirmed its full-year 2024 revenue growth guidance of 7-9% and an underlying operating margin of 70%, the loss of OpenRent’s listings sparked worries about the potential impact on Rightmove’s lettings business.

Rightmove acknowledged that the market dynamics within lettings are fluid, and this change could lead to a membership decline of up to 3% year-on-year, despite an expected increase in Average Revenue Per Advertiser (ARPA).

Investors reacted to the uncertainty surrounding the future mix of membership and revenue, leading to a dip in Rightmove’s stock. Concerns also stemmed from the fact that OpenRent’s departure means its landlord customers will lose access to Rightmove’s extensive audience, potentially affecting the portal’s overall market share in the lettings segment.

REGENCY VIEW:

Rightmove is facing increasing competition and headwinds from a property market that has been weakened by high interest rates. The shares trade on a forward PE ratio of 18.5 and this looks expensive relative to its peers, the wider market, and relative to single-digit forecasted growth in earnings per share.

Sector Snapshot

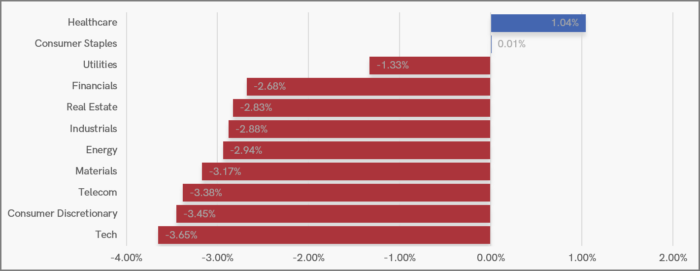

Our seven-day UK Sector Snapshot captures last Thursday and Friday’s losses, along with Monday’s sharp sell-off.

The recent US tech slump has spilled over into the UK market, placing Tech at the bottom of the rankings this week. Meanwhile, Consumer Discretionary, which had demonstrated several weeks of strength, has experienced profit-taking.

On the other hand, sectors showing relative strength include Healthcare, with Pharma stocks holding steady, and Consumer Staples, which have maintained their strong performance over several weeks.

UK Price Action

With the recent surge in volatility, gaining perspective becomes crucial. By zooming out on our price chart, we can better understand the FTSE’s recent movements.

Monday’s sell-off led to the formation of a new swing low near the February 2023 highs—a significant level where previous resistance has now turned into support. This new swing low aligns with the 200-day moving average (MA) and the volume-weighted average price (VWAP) anchored to the October 2023 lows.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.