2nd Aug 2024. 9.58am

Weekly Briefing – Friday 2nd August

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.28% |

| FTSE 250 | -0.54% |

| FTSE All-Share | -0.32% |

| AIM 100 | -0.04% |

| AIM All-Share | -0.46% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 2nd August

Market Overview

Dear Investor,

UK stocks are back in fashion this summer and we’re starting to see a shift in the global investment landscape. After several years of underperformance and scepticism, the tide is turning for London-listed stocks. Major players in the asset management industry, including BlackRock, Allianz, Ruffer, and Rathbones, are increasing their exposure to UK equities.

Several factors are driving this resurgence. The UK economy is showing signs of recovery, with falling inflation rates and a stable economic outlook. This stability is encouraging investors to reconsider UK stocks, which have been undervalued for some time.

The recent general election has resulted in the perception of a stable government, fostering a positive environment for business and investment. Additionally, attractive valuations relative to US and European peers are drawing global investors hunting for value.

In July, UK equities have outperformed both US and European stocks, with the FTSE 350 rising more than 3%, compared to less than 1% gains in the US and Europe. This outperformance underscores the growing appeal of UK stocks and suggests a potential period of sustained growth ahead.

Despite the past struggles, the renewed optimism is evident as institutional investors have moved from being net sellers to net buyers of UK equities. The shift is further supported by data showing consistent inflows into mid-sized UK stocks, marking a significant change from previous trends.

The potential for a period of catch-up with other global markets is becoming increasingly likely, and our FTSE Investor and AIM Investor services are perfectly positioned to benefit.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Next (LSE:NXT) +% on the week

Shares in fashion retailer Next surged higher on Thursday following a market-beating trading update that significantly exceeded analysts’ expectations.

The company’s second-quarter performance saw full price sales rise by 3.2%, despite forecasts predicting a 0.3% decline due to last summer’s exceptionally favourable weather conditions for clothing retailers. This robust performance led Next to increase its profit guidance for the full year by £20 million to £980 million, marking a 6.7% increase compared to last year.

Key contributors to this positive update included a substantial increase in overseas online sales, which grew by 21.9% in the second quarter, and the successful integration of recent acquisitions, FatFace and Reiss, which bolstered overall group sales by 8.0% in the first half. Additionally, Next’s cost-saving measures, particularly in logistics, contributed £9 million to the profit boost.

In response to the upbeat trading update, investors showed strong confidence in the company’s future prospects, leading to a significant rise in Next’s share price.

REGENCY VIEW:

Next has earned praise for its ability to swiftly adapt to the changing landscape of retail, particularly with the shift towards online shopping. The company has demonstrated adept crisis management strategies, distinguishing it from its competitors.

The shares trade on a premium valuation 14x forward earnings. This looks high relative to its peer group, the wider market, and forecasted growth in earnings per share of less than 5%.

Shares in Ladbrokes owner Entain dropped sharply this week after the company announced a significant profit downgrade.

The decline was triggered by BetMGM, Entain’s US joint-venture partner, which revealed plans to increase its marketing spend on iGaming in the latter half of the year. This unexpected expense is projected to result in continued losses for BetMGM, mirroring the £123 million loss reported in the first half of 2024.

Despite management’s optimistic outlook on the investment’s potential to drive future growth and enhance customer experience, the market reacted negatively. Investors were concerned about the delay in medium-term profitability and the impact on analysts’ expectations.

Adding to the pressure, activist investor Eminence Capital, led by Jerry Sandler who joined Entain’s board in January, has been pushing for the company to consider selling its stake in the BetMGM joint venture. This call for action stems from Entain’s previous rejections of lucrative takeover offers, including a £13.85 per share bid from MGM Resorts International in 2021 and a proposed £28 per share offer from DraftKings, both of which are significantly higher than the current share price.

The leadership instability at Entain has also contributed to investor unease. The company has seen several CEO changes, with Jette Nygaard-Anderson departing abruptly in December 2023 following a £585.5 million settlement of a Crown Prosecution case. Her predecessors, Kenny Alexander and Shay Segev, also left amidst regulatory investigations and leadership turmoil. The recent appointment of Gavin Isaacs as CEO on July 22, who brings 25 years of industry experience, including a stint at DraftKings, has sparked some speculation about potential future takeover attempts.

REGENCY VIEW:

The combination of increased marketing expenditures, delayed profitability, leadership changes, and activist investor pressure has created significant uncertainty, causing Entain’s shares to plummet.

Sector Snapshot

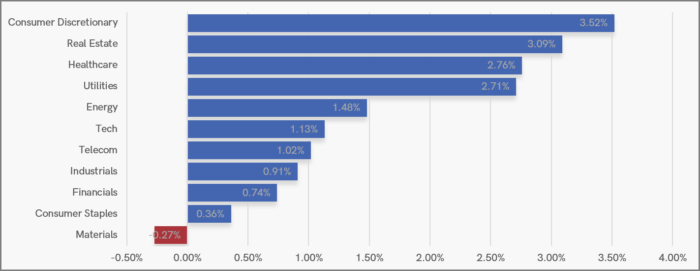

Our seven-day UK Sector Snapshot is a sea of blue this week as it includes last Thursday and Friday’s gains.

Consumer Discretionary has continued to show high levels of relative strength – a theme we have seen develop during the last month. Real Estate was given a boost by a better-than-expected jump in UK house prices during July and yesterday’s rate cut from the Bank of England.

Another consistent theme is weakness in Materials as concerns over Chinese economic growth weigh heavily on commodity prices.

UK Price Action

The FTSE broke out from its summer wedge on Friday last week and made a second push higher on Wednesday. However, a sharp sell-off in US stocks on Thursday due to weak manufacturing data dragged the FTSE lower. For the wedge breakout to hold, the FTSE needs to stay above its 50-day moving average.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.