1st Aug 2024. 10.07am

Regency View:

BUY IG Design (IGR)

Regency View:

BUY IG Design (IGR)

IG Design’s transformational turnaround

The journey to growth for small companies is rarely smooth sailing. Market volatility, economic downturns, and internal inefficiencies often pose significant challenges. Yet, these hurdles can also serve as catalysts for transformation, driving companies to refine their strategies and emerge stronger.

IG Design (IGR) epitomises this dynamic, demonstrating how strategic turnarounds can pave the way for sustainable growth and create compelling investment opportunities.

The turnaround story: From struggle to strength

IG Design, a prominent designer, innovator, and manufacturer of celebration and creative products like gift wrap, stationery, and craft items, has successfully navigated a significant turnaround. Serving key markets in the United Kingdom, North America, and continental Europe, IG Design provides a diverse range of products for both retail and wholesale customers, addressing various celebratory and creative occasions.

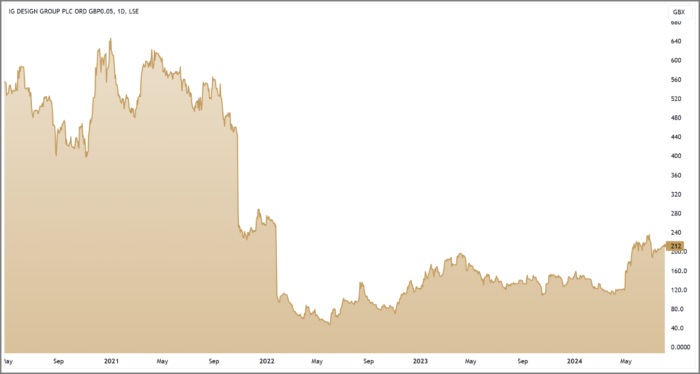

Before the pandemic, IG Design was a standout performer on AIM, celebrated for its impressive growth and market strength. However, the post-pandemic global supply chain crisis had a devastating impact on the company. Disruptions in global logistics networks caused severe delays and inflated raw material costs, posing significant challenges for IG Design’s just-in-time delivery model and cost-efficient sourcing. Additionally, intensified competition among retailers and strained inventory management hindered the company’s ability to meet customer demand and maintain profit margins.

The impact of the crisis was stark, with IG Design’s share price plummeting by more than 90% between February 2020 and May 2022. This dramatic decline marked a period of intense difficulty but also catalysed a decisive shift. In June 2022, IG Design launched a comprehensive turnaround strategy aimed at restoring operational efficiency, simplifying the business, and regaining financial stability.

Key initiatives driving this turnaround included:

1. Restructuring Initiatives: Strategic restructuring in the DG Americas and DG International divisions has been crucial. This restructuring has led to significant profit improvements and more effective sourcing practices.

2. Operational Efficiency: Focused efforts on improving operational efficiency and managing working capital have resulted in substantial cost savings and enhanced cash generation.

3. Leadership Changes: The appointment of Rohan Cummings as CFO in July 2023 introduced new financial oversight, contributing to better financial management and strategic direction.

4. Market Adaptation: Despite challenges such as subdued consumer sentiment and sea-freight volatility, IG Design has strengthened customer relationships and managed credit risks in the competitive US retail environment.

These strategic initiatives have not only stabilised IG Design’s operations but also positioned it for sustained growth. The company’s resilience and adaptability are evident in its successful navigation through a period of significant adversity, paving the way for a promising recovery and future success.

Current position and promising outlook

IG Design’s latest financial results underscore its successful turnaround:

- Revenue: Although revenue declined by 10% to $800.1 million, this was largely due to market conditions and strategic restructuring.

- Profitability: The company reported a remarkable recovery in profitability, with an adjusted operating profit of $31.1 million, up from $16.1 million in the previous year. The adjusted profit before tax surged by 183% to $25.9 million.

- Cash position: A robust net cash balance of $95.2 million, up from $50.5 million, highlights strong cash generation and effective working capital management.

- Margins: Adjusted operating profit margin improved by 210 basis points to 3.9%, with a target to reach pre-COVID-19 levels of 4.5% by March 2025.

Looking ahead, IG Design is poised to transition from a focus on turnaround to executing a growth-focused strategy. The company aims to achieve annual sales of over $900 million and an adjusted operating profit margin of over 6% by March 2027. The FY2025 order book, covering 69% of budgeted revenues, reflects strong customer relationships and positions the company well for future growth.

Catching the second wave

When investing in turnaround stocks, a prudent strategy is to capitalise on the second wave of recovery, which often follows an initial rebound. IG Design’s impressive share price surge from April to June reflects the market’s positive sentiment shift.

The recent pullback to the 50-day moving average—now above the 200-day moving average—signals a bullish shift in momentum and creates a platform for buying into a second wave higher.

Currently, IG Design’s market capitalisation of just over £200 million suggests the stock is trading below its intrinsic value relative to future growth prospects. The forward P/E ratio of 10.8 and the price-to-book value of 0.74 highlight the stock’s attractive valuation. Particularly noteworthy is the company’s price-to-free cash flow ratio of 4.0, indicating robust cash generation efficiency. The EV/EBITDA ratio of 4.09 further underscores the company’s strong earnings relative to its enterprise value.

These valuation metrics, coupled with IG Design’s recent turnaround and positive outlook, suggest the stock is undervalued and positioned for substantial appreciation. The company’s strategic recovery and solid growth trajectory make it a compelling opportunity in the small-cap sector.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.