24th Jul 2024. 8.59am

Regency View:

BUY IntegraFin Holdings (IHP)

- Growth

Regency View:

BUY IntegraFin Holdings (IHP)

IntegraFin: A Fintech with plenty of momentum

Momentum investing can be psychologically challenging. You’re buying high to sell higher, which can sometimes feel counterintuitive and nerve-wracking.

However, a focus on financial quality is probably the best way to safeguard against the lofty valuations that come with momentum stocks. Fintech company, IntegraFin Holdings (IHP), with its impressive blend of proprietary technology and strategic growth, is a prime example of a high-quality momentum stock. Here’s a closer look at what makes IntegraFin a compelling investment opportunity.

Proprietary technology powering growth

IntegraFin’s secret sauce lies in its cutting-edge technology, especially with its flagship Transact platform and CURO software. Transact isn’t just any investment platform; it’s a powerhouse giving financial advisers and their clients top-tier tools for managing investments. Think of it as the sleek sports car of investment platforms – fast, secure, and a joy to use.

So, how does IntegraFin make money? They primarily earn through fees charged on their Transact platform. These fees come from several sources: annual platform fees, transaction fees, and custody fees for holding clients’ assets. The more assets under direction (FUD) and the higher the transaction volume, the more revenue IntegraFin generates. It’s a scalable model that benefits from both the growth in user base and the increase in asset value.

IntegraFin’s CURO software is built on Microsoft Dynamics 365 and Power Platform, making its service offerings even more robust. It’s like an advanced toolkit for financial planning and wealth management, integrating CRM functionality, client engagement, and sophisticated data analysis. The Power Platform’s features – Power BI, Power Apps, and Power Automate – let firms really dig into their data for smarter decisions.

By weaving these technologies into its operations, IntegraFin is leapfrogging the competition and have put themselves at the forefront of integrating tech into the financial services world. Their proprietary technology ensures they can offer a high-quality, seamless experience for advisers and clients, driving customer satisfaction and long-term loyalty.

Strong Q3 trading update

Just last week, IntegraFin released a strong Q3 trading update which maintained the momentum built during the first half of their financial year…

For the quarter ending June 30th, the company hit a record with £62.4 billion in funds under direction (FUD). That’s a 2% increase from the last quarter and a significant 14% jump over the past year. The average daily FUD also set a new record at £61.4 billion, showcasing consistent, impressive growth.

IntegraFin pulled in net inflows of £0.7 billion and gross inflows of £2.0 billion, highlighting strong market confidence and demand for their platform. Adviser numbers grew to about 8,000, and the client base expanded to 234,000. Plus, CURO software continues to gain traction with over 3,000 chargeable users, proving its growing impact and adoption.

High margin business with strong financials

IntegraFin’s financial health is rock solid. With revenues of £138.80 million and a net profit of £52.3 million, their operating margin stands tall at 80.04%. The return on equity (ROE) is an impressive 28.8%, and the return on capital employed (ROCE) hits 44.1%, showing outstanding profitability and operational efficiency.

Of course, with quality and momentum comes a high valuation and IntegraFin’s share trade on a forward PE ratio of 23.2 – not outrages but enough to urge caution. However, this valuation is supported by the company’s robust fundamentals and consistent growth trajectory.

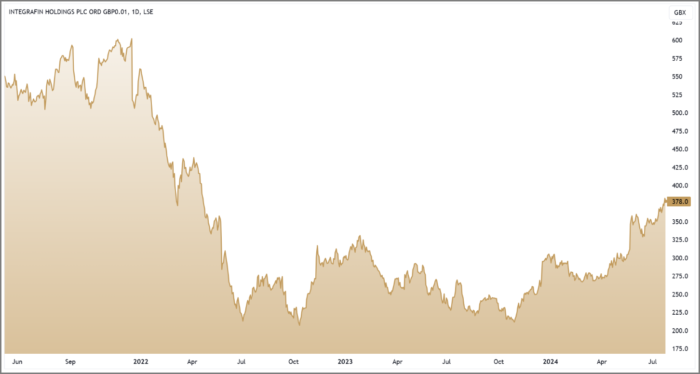

On the price chart, IntegraFin has generated plenty of bullish momentum this year. The shares are trading comfortably above the 50-day moving average (MA), indicating strong short-term momentum. This is even more significant when considering the 50-day MA is diverging from the 200-day MA, a classic bullish signal known as a “golden cross.” This technical setup suggests that the uptrend has solid backing and may continue its trajectory.

IntegraFin is a prime example of how blending innovative technology with a solid strategic vision can lead to impressive growth and market success. If you’re looking for a stock with both quality and momentum, IntegraFin is definitely worth your attention.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.