19th Jul 2024. 10.56am

Weekly Briefing – Friday 19th July

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.12% |

| FTSE 250 | -0.62% |

| FTSE All-Share | -1.03% |

| AIM 100 | -0.26% |

| AIM All-Share | -0.28% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 19th July

Market Overview

Dear Investor,

It’s been a week of US politics like no other. The attempted assassination of Donald Trump and his uncanny ability to exploit such situations have dramatically shifted the odds of the presidential election in Teflon Don’s favour, impacting both the political landscape and financial markets in significant ways.

Trump’s immediate response to the assassination attempt has been to pivot his campaign message towards national unity, a striking departure from his usual divisive rhetoric. This strategic shift aims to consolidate his base while reaching out to undecided voters.

President Joe Biden, on the other hand, is facing increasing pressure to step aside as images of him gingerly walking up the stairs of Air Force One after testing positive for COVID-19 contrast starkly with Trump’s now iconic ‘fight, fight, fight’ photograph.

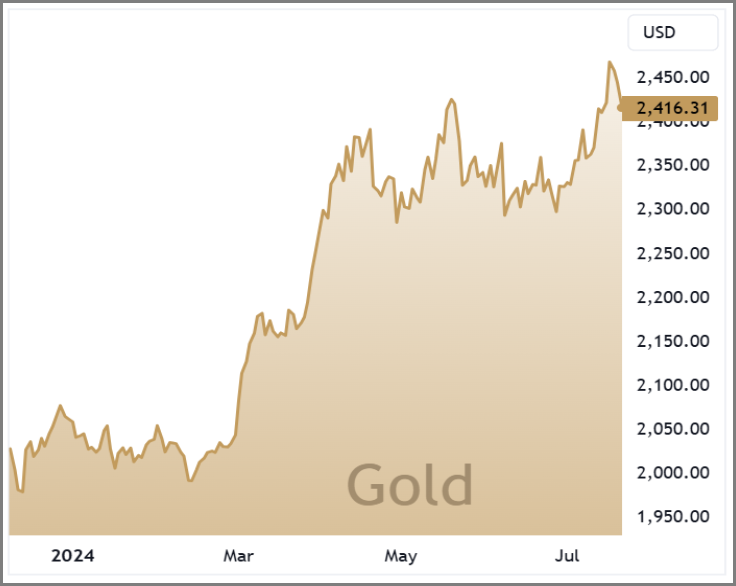

The reaction across financial markets has played into the hands of gold bugs and crypto enthusiasts. Gold, seen as a safe haven, surged to record highs as investors sought stability. In the cryptocurrency market, Bitcoin and other digital assets saw significant gains. Trump’s support for cryptocurrencies and his campaign’s acceptance of digital currency donations have boosted investor confidence.

On the flip side, semiconductor stocks saw sharp declines following Trump’s comments about Taiwan and potential tougher US trade restrictions on China. These geopolitical tensions have raised concerns about supply chain disruptions and the future of semiconductor exports, leading to a significant sell-off in the market. Companies like Nvidia and AMD, along with European counterparts such as ASML, experienced substantial drops in their stock prices, highlighting the sector’s vulnerability to political instability.

This week has shown just how closely intertwined politics and financial markets can be. The attempted assassination of Donald Trump has not only reshaped the US presidential campaign but may also be reshaping how portfolio managers position themselves heading into election season.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Alumasc (AIM:ALU) +13.3% on the week

AIM-listed Alumasc surged higher this week following an upbeat trading statement that revealed the company’s impressive performance for the fiscal year ending 30 June 2024.

The sustainable building products group reported that its underlying profit before tax is now expected to be at least £12.6 million, surpassing market forecasts and last year’s profit of £11.2 million.

Alumasc’s strong performance was driven by several key factors. The company achieved significant organic revenue growth of approximately 6.5%, outstripping the overall UK construction market, which experienced a decline of about 2%. This growth was attributed to successful innovation and commercial initiatives across its divisions.

The group’s three divisions—Building Envelope, Housebuilding Products, and Water Management—all reported higher revenue, operating margins, and profits compared to the previous fiscal year. Notably, the Building Envelope division gained market share due to investments in sales resources and sustainable roofing solutions, while Housebuilding Products launched new items that mitigated the impact of decreased housing starts.

CEO Paul Hooper expressed optimism about Alumasc’s growth strategy, emphasising the company’s focus on environmentally sustainable solutions, capability enhancement, and continued self-help initiatives to drive further growth in returns.

REGENCY VIEW:

We’ve been big fans of Alumasc for several years due to the quality of its financial and undemanding valuation. Having taken profits in July 2021, we re-entered the stock in May 2023 – CLICK HERE to read our full recommendation.

Shares in Burberry dropped sharply this week after the luxury fashion group announced significant leadership changes and issued a profit warning.

The shares dropped more than on Monday following the announcement that CEO Jonathan Akeroyd, who had been in the role for two years, would be leaving immediately “by mutual agreement.” He is being replaced by Joshua Schulman who has experience leading luxury brands such as Coach and Jimmy Choo.

In addition to the CEO change, Burberry suspended its dividend to strengthen its balance sheet amidst weakening trading conditions. The company reported that sales fell across all markets except Japan in the first quarter, resulting in a 21% drop in same-store sales. This poor performance has prompted Burberry to forecast an operating loss for the first half of the year and lower annual profit expectations.

Burberry also confirmed ongoing consultations about potential redundancies, primarily affecting corporate roles in the UK. This restructuring aims to streamline operations and improve financial stability amid declining sales.

REGENCY VIEW:

Burberry’s attempted upmarket repositioning has failed, and the brand is struggling to maintain momentum. The sell-off in Burberry’s share price this year underscores the significant hurdles the company faces as it navigates a volatile luxury market and attempts to restore investor confidence.

Sector Snapshot

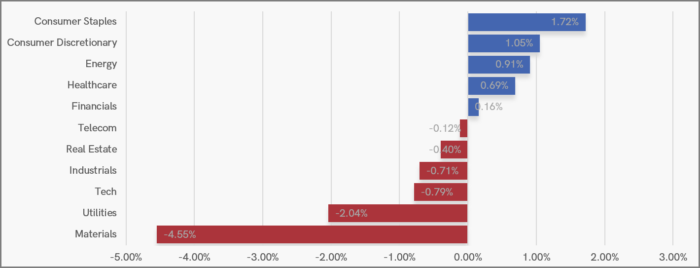

This week’s Sector Snapshot is dominated with weakness in Materials with mining stocks hit hard on concerns about the Chinese economy and Rio Tinto’s production report.

In contrast, it’s been a strong week for consumer stocks, with Consumer Staples and Consumer Discretionary topping the charts, buoyed by gains from Tesco, Unilever and British American Tobacco.

UK Price Action

The FTSE’s summer wedge pattern, that we’ve highlighted for several weeks has continued to take shape. Short-term traders will be watching closely for a decisive breakout backed by strong volume.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.