10th Jul 2024. 9.03am

Regency View:

BUY Volution (FAN)

- Growth

Regency View:

BUY Volution (FAN)

Volution: A breath of fresh air in sustainable ventilation

With the new Labour government setting ambitious sustainability targets, companies like Volution (FAN) are poised to thrive.

As regulations tighten and consumer preferences shift towards eco-conscious products, Volution is perfectly positioned at the forefront of the ventilation products sector across Europe and Australasia.

Innovative solutions powering a greener tomorrow

Volution isn’t merely compliant—it’s a trailblazer in sustainable building practices. A remarkable 70% of its revenue streams from advanced, low-carbon products that not only adhere to regulatory requirements but set benchmarks for the industry.

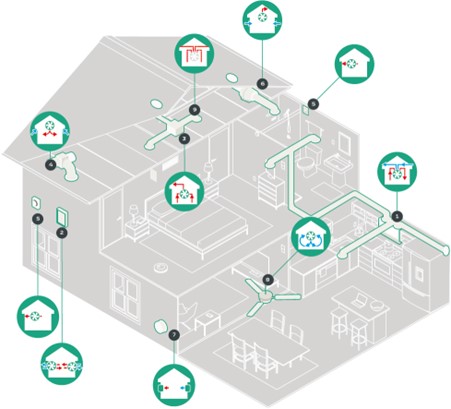

- Mechanical ventilation:

Central to its portfolio are state-of-the-art Mechanical Ventilation with Heat Recovery (MVHR) systems. These innovative solutions are designed to recover heat from outgoing air streams, drastically reducing energy consumption associated with indoor climate control. By delivering fresh, filtered air while retaining heat, MVHR systems not only contribute to lower energy bills but also significantly diminish carbon footprints, aligning perfectly with sustainable building practices.

Complementing MVHR systems are Volution’s Decentralized MVHR (dMVHR) setups, offering flexible, localised ventilation solutions with heat recovery capabilities. These systems adjust ventilation rates based on occupancy and environmental conditions, optimizing energy usage and enhancing indoor air quality (IAQ).

Additionally, Volution’s Mechanical Extract Ventilation (MEV) systems play a pivotal role in residential applications by continuously extracting stale air from multiple points within homes, such as bathrooms and kitchens. This not only promotes better air circulation and humidity control but also operates at lower energy levels compared to traditional intermittent fans, contributing further to energy savings and environmental sustainability.

- Passive ventilation:

Further enhancing its product lineup, Volution’s Positive Input Ventilation (PIV) systems are passive ventilation solutions. By utilising gentle air pressure differentials, PIV systems expel stale indoor air while introducing fresh, filtered air into living spaces. This approach not only enhances IAQ but also minimises energy consumption by harnessing natural air movement principles. PIV systems are particularly effective in retrofitting existing buildings where conventional ventilation methods may prove impractical or costly.

- Ducting:

Integral to Volution’s ventilation solutions are its ducting products. These encompass a range of materials and configurations tailored to specific installation requirements, including rigid, semi-rigid, and flexible ducting. Ensuring efficient airflow distribution while minimizing energy losses and operational noise, these components are crucial to the overall performance and energy efficiency of Volution’s systems.

1. MVHR 2. dMVHR 3. MEV 4. PIV 5. Single room extract fans 6. Inline fans 7. Passive ventilation 8. Thermal destratification 9. Ducting

Building an economic moat fit for Warren Buffett

Warren Buffett’s timeless concept of an economic moat—a sustainable competitive advantage—aptly describes Volution’s market position.

At the core of this moat is its strong brand loyalty and recognition, earned through decades of commitment to quality and innovation. Customers trust Volution not just for its products but for its consistent delivery of cutting-edge solutions that meet evolving market demands.

Volution’s continuous investment in research and development ensures it remains at the forefront of technological innovation within the ventilation sector. This ongoing innovation not only drives product differentiation but also enables the company to adapt swiftly to changing regulatory landscapes and customer preferences. Expertise in navigating complex regulatory environments further strengthens Volution’s barriers to entry, making it challenging for competitors to replicate its success.

Operational scale efficiencies derived from its global footprint and optimised supply chain bolster Volution’s competitive position. These efficiencies not only enhance cost management but also enable the company to maintain robust profitability and reinvest in growth initiatives.

Financial fortitude: A pillar of stability

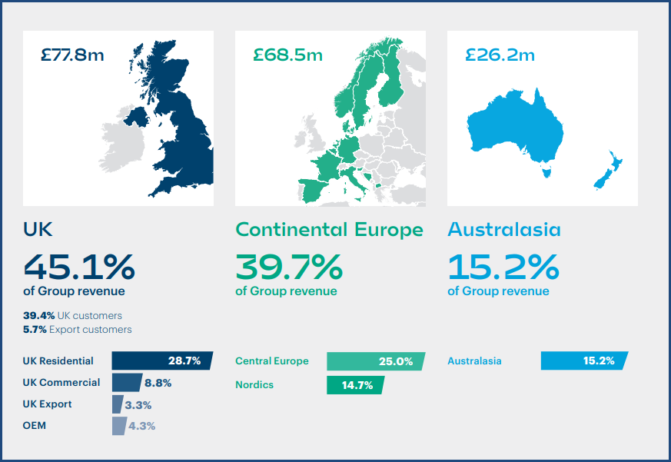

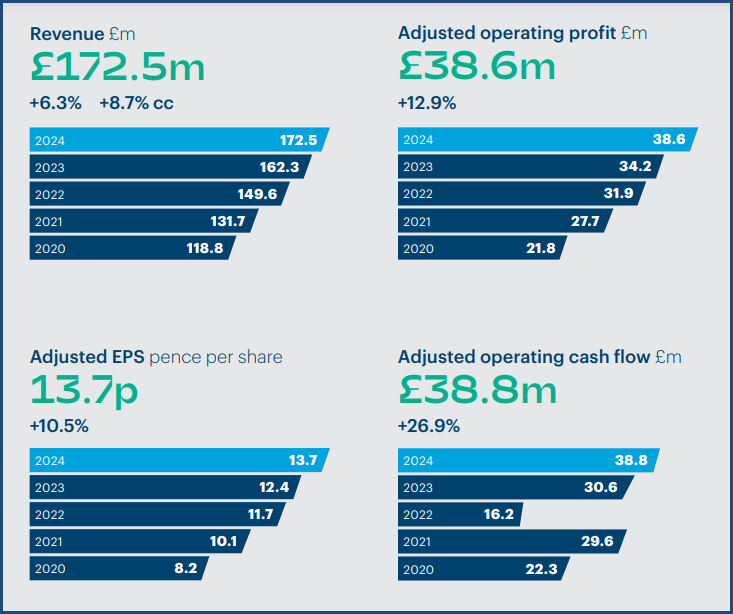

Beyond its innovative prowess and market leadership, Volution boasts a rock-solid financial foundation. Its track record speaks volumes: over recent years, the company has consistently demonstrated strong revenue growth, averaging a compound annual growth rate (CAGR) of 9.78%. This growth trajectory reflects both organic expansion and strategic acquisitions that have broadened its geographic reach and product portfolio.

Profitability metrics underscore Volution’s operational excellence. The company has steadily improved its operating margins, reaching an impressive 18.1% as of the latest trailing twelve months (TTM) data. This upward trend highlights efficient cost management practices and operational effectiveness across its global operations.

One of Volution’s standout financial strengths is its ability to generate substantial cash flows. With an average cash conversion rate of 98% over the last five years, the company efficiently translates its operating profits into actual cash flow. This high cash conversion rate not only supports ongoing operational needs but also enables Volution to pursue strategic investments and return value to shareholders through dividends or share buybacks.

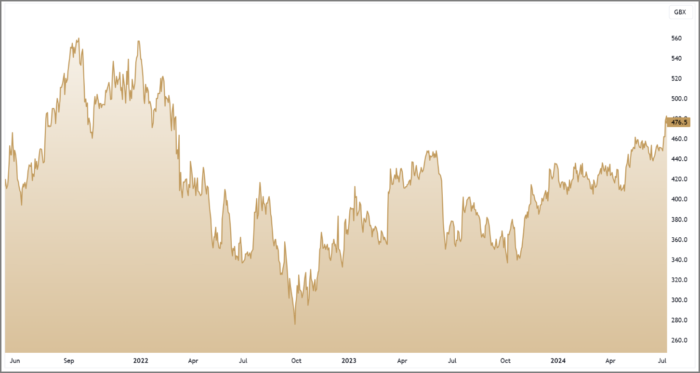

Technical timing

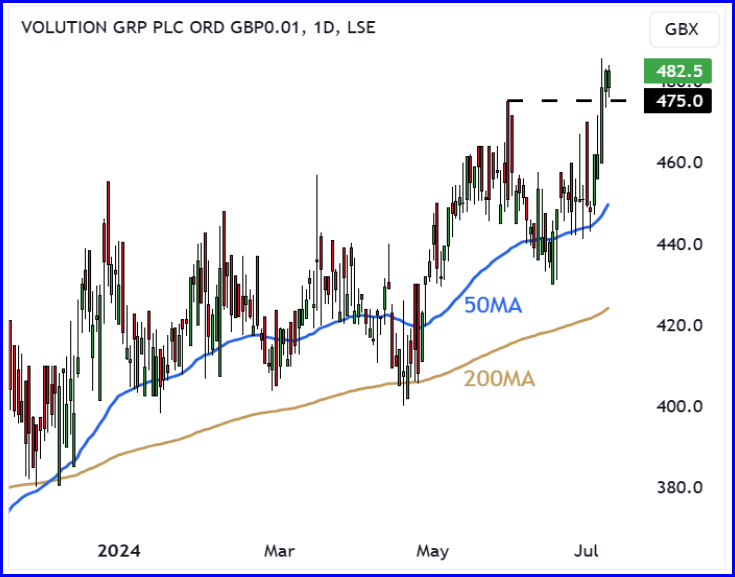

Those who follow our research will know that we like to look for a technical catalyst to complement our stringent fundamental requirements. During the last week, a clear technical catalyst has emerged with prices breaking to new trend highs.

The technical trigger is set against a backdrop of bullish momentum and relative strength. The shares have been trading comfortably above both their 50-day moving average (MA) and 200 day MA since the turn of the year – carving out a strong uptrend.

Over the past three months, Volution has demonstrated a relative strength of +12.3%, underpinning its consistent short-term outperformance. Zooming out to a twelve-month perspective reveals Volution’s exceptional relative strength at +20.9%, highlighting its substantial outperformance compared to the broader FTSE 100 index.

These metrics underscore Volution’s capability to consistently generate superior returns, making it an attractive choice for investors seeking growth and stability in their portfolios.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.