4th Jul 2024. 9.01am

Regency View:

BUY PetroTal (PTAL)

Regency View:

BUY PetroTal (PTAL)

PetroTal: The small oil stock with big growth plans

In a market dominated by giant oil companies, PetroTal (PTAL) stands out as a small oil stock with immense growth potential.

This Peruvian-focused oil and gas company is making significant strides with its strategic development plans, robust financial health, and attractive valuation, presenting a compelling opportunity for small-cap investors.

Unleashing growth potential in the Peruvian oil sector

PetroTal is dedicated to the exploration, development, and production of oil assets in Peru. With deep expertise in developing oil fields in Northern Peru, PetroTal aims to operate safely and cost-effectively while contributing to the economic development of the country.

The company’s key assets include the Bretaña oil field (Block 95) and the promising Osheki prospect in Block 107…

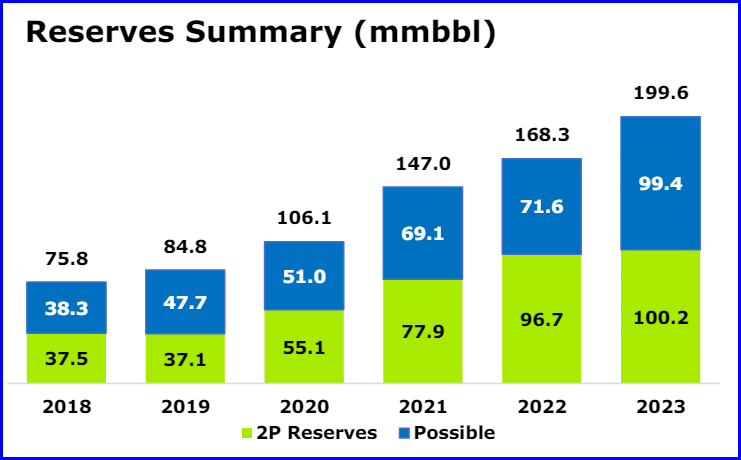

The Bretaña oil field is a massive heavy oil field located in the Marañón Basin along the Ucayali River. Since initiating production in June 2018, PetroTal has developed 18 producing wells, leveraging advanced technologies like AICD for water control and aquifer support. Currently, the field has a production target of 17,000 barrels of oil per day (bopd) for 2024, with a budget of $134 million.

The Osheki prospect, with mean estimate unrisked prospective resources of 534 million barrels of oil (MMBO), holds significant potential for future growth, backed by new seismic data and an approved drilling program.

The path to a $2bn market cap: PetroTal’s strategic expansion plans

PetroTal’s short-term strategy is focused on maximising production efficiency and ensuring a steady return of capital to shareholders…

The company plans to execute its 2P and 3P development plans by drilling wells without overspending on facilities and infrastructure. This approach aims to maintain a long-term production profile of over 10,000 bopd for more than 15 years. PetroTal has also implemented a structured share buyback program and established a quarterly dividend, with a cash sweep enhancement, providing a stable and attractive return for investors.

In the long term, PetroTal aims to achieve $2 billion in market capitalisation through accretive mergers and acquisitions in North and South America, along with inorganic growth opportunities within Peru.

The company plans to continue its exploration and development activities in Blocks 95 and 107, aiming to drill 3-4 wells annually while minimizing downtime. Additionally, PetroTal aims to exceed ESG targets, including carbon offset projects and biodiversity preservation initiatives.

Financial strength and stability

PetroTal boasts a debt-free balance sheet, positioning the company favourably to maximise free cash flow to investors. This financial stability allows PetroTal to de-risk its balance sheet in the long term and access debt capital if necessary.

The company’s revenue for the last fiscal year was $248.42 million, with an operating margin of 59.13% and a return on equity of 31%, showcasing its profitability and operational efficiency.

PetroTal’s financial health is further highlighted by its strong liquidity, with a current ratio of 2.43 and a quick ratio of 2.26. The company’s cash generation capabilities are impressive, with a projected adjusted EBITDA of approximately $200 million in 2024.

Additionally, PetroTal’s net profit has shown significant growth, reaching $141 million in the trailing twelve months, with a robust operating cash flow per share of $0.228.

Compelling value for risk-aware investors

PetroTal’s exclusive focus on Peru brings with it significant geopolitical risks, which investors should not overlook. We recommend a diversified small-cap portfolio across different geographies and sectors to mitigate such risks.

However, for those who are comfortable with these risks, we believe PetroTal’s share price presents an attractive opportunity. The stock is trading at a significant discount to its estimated fair value, with a forward P/E ratio of 3.6 and a PEG ratio of 0.5, indicating it is undervalued relative to its growth potential.

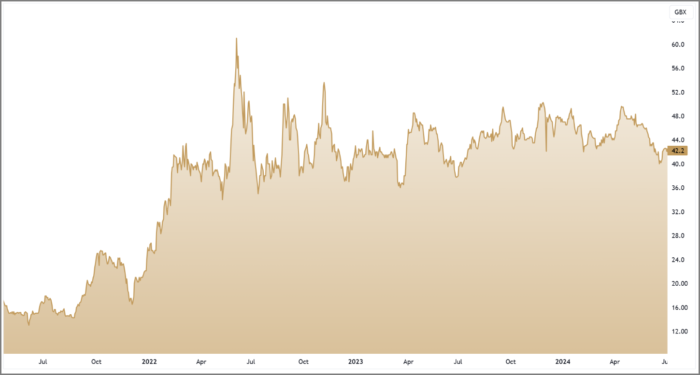

PetroTal also offers a high dividend yield of 9.09%, making it appealing to income-focused investors. Currently trading at around 42p, the stock reflects a 47.5% discount to its estimated fair value. This substantial discount provides significant potential for capital appreciation as the company continues to execute its growth strategy and unlock value from its key assets.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.