27th Jun 2024. 8.59am

Regency View:

Update

Regency View:

Update

Alpha FMC surge amid takeover speculation by Bridgepoint

Alpha Financial Markets Consulting (AFM) surged higher last week following bid speculation from Bridgepoint, a London-listed buyout firm.

Alpha FMC boasts a global presence with over 900 consultants and the potential takeover by Bridgepoint is viewed as a strategic move to leverage Alpha’s expertise and market position.

The bid speculation comes at a crucial time as both Bridgepoint and rival private equity group Cinven have expressed interest in acquiring Alpha. An official offer from Bridgepoint is anticipated to be around 500p per share, amounting to an overall valuation of approximately £550 million.

This potential acquisition underscores the growing trend of private equity firms targeting specialist consulting firms to enhance their portfolio and market reach.

With a Takeover Panel deadline looming, the market is closely watching for an official announcement. We will of course keep you updated with the developments.

Good Energy reports strong performance with increased profitability and commercial installations

Good Energy (GOOD) has issued a short but sweet update for the year to date…

The 100% renewable electricity supplier and energy services provider said it has continued to perform well throughout the year so far. The company reported stronger supply profitability, which has been a key driver of its positive performance.

Additionally, Good Energy has seen an increase in commercial installations, further bolstering its overall growth. However, this success was slightly offset by weaker domestic installation volumes. Despite this, the Board remains confident and has maintained its expectations for the full year, indicating stability and a positive outlook for the company’s financial health.

The shares initially rallied in response to the update but have since retraced. Looking ahead, Good Energy announced that it will release its interim financial results for the six-month period ending 30 June 2024 on Tuesday, 17 September 2024.

M.P. Evans initiates share buyback program

M.P. Evans (MPE) released a bullish trading statement last week, signalling robust performance in its operations.

The sustainable palm oil producer reported strong financial results, driven by increased production and favourable pricing dynamics in the palm oil market.

M.P. Evans produced 147,500 tonnes of crude palm oil (CPO) in the first five months of 2024, a 10% increase from 134,400 tonnes in the same period in 2023. Most of this CPO (96%) came from the Group’s own mills, with an average oil-extraction rate of 23.4%, up from 23.0% in 2023.

As a testament to its confidence in future prospects and shareholder value, MPE announced a share buyback initiative. The decision to implement a share buyback reflects MPE’s proactive approach to capital management and its commitment to enhancing shareholder returns.

By repurchasing its own shares, MPE aims to optimise its capital structure and bolster earnings per share, signalling optimism about its financial strength and growth trajectory.

Furthermore, MPE’s bullish outlook is supported by strategic initiatives such as expanding its plantation holdings and improving operational efficiency.

Science Group trading ‘in line’ with expectations

Science Group (SAG) has provided a trading update ahead of its Annual General Meeting.

The ‘science-as-a-Service’ consultancy stated that its performance in the initial months of 2024 is “in line with the Board’s expectations”.

Specifically, Science Group anticipates that Adjusted Operating Profit for the interim period ending 30 June 2024 will surpass the figures from the previous year.

Science Group said this positive outlook is underpinned by the Group’s diversified business portfolio across various sectors, which has contributed to a resilient performance in the first half of the year, despite uncertainties in the political and market environments.

As of 31 May 2024, Science Group reported holding gross cash reserves amounting to £38.1 million, with net funds totalling £25.4 million. The company said this strong cash position provides the Board with flexibility to explore potential corporate opportunities and to continue its share buy-back program throughout the latter part of the year.

Surface Transforms updates FY23 audit: Impairments and revenue recognition adjustments

Ceramic brake disc maker, Surface Transforms (SCE) provided an update on its FY23 audit. The audit, initially expected to conclude by late June 2024, has encountered delays primarily due to anticipated non-cash impairments.

These impairments are significant, totalling £6.2 million on intangible assets such as capitalised research and development, software, and right of use assets. This adjustment follows a reassessment using a higher discount rate to address risks in cash flow forecasting and market value gaps.

In addition, tangible assets are also affected, with £3.0 million in impairments expected. This includes a particular furnace that has not met contracted specifications despite extensive engineering reviews with suppliers. However, current production remains stable due to higher-than-planned output from another furnace and outsourcing arrangements.

Furthermore, Surface Transforms revised its revenue recognition policy regarding engineering, testing, and tooling services provided during contract development phases. Under the updated policy, revenue will now be recognised upon completion of system integration by the original equipment manufacturer (OEM) or when control is transferred to the customer.

This adjustment is expected to defer approximately £2 million in revenue from FY23 and earlier periods into future fiscal years. Despite these accounting changes, the company assured stakeholders that its daily operational performance and cash flow remain unaffected.

Surface Transforms said it maintains confidence in its financial stability, supported by a robust order book amounting to £390 million, which continues to drive ongoing revenue generation from its products and services.

Synectics secures $10m contract for major gaming resort surveillance upgrade

Synectics (SNX) has announced a major contract win valued at approximately US$10 million. The contract involves upgrading and expanding the surveillance system at a prominent gaming resort in South-East Asia, one of the world’s most successful gaming destinations.

The project is slated to begin late in Synectics’ current financial year, ending 30 November 2024, with completion expected by the end of the following financial year, ending 30 November 2025. The Customer, a long-term client using Synectics’ Synergy software since 2014, will have their existing system enhanced to the latest version of Synergy.

Paul Webb, Chief Executive Officer of Synectics, expressed enthusiasm about the contract, highlighting the significant market opportunity within the casino and leisure sector in Asia. He emphasised that the Customer’s commitment to this substantial long-term upgrade underscores the effectiveness of Synergy and the quality of Synectics’ ongoing support.

Supreme acquires Clearly Drinks to boost earnings and diversify products

Supreme (SUP) has acquired Clearly Drinks for £15 million. This strategic acquisition adds diversity to Supreme’s earnings and is expected to be immediately earnings enhancing.

Clearly Drinks, is a well-known UK manufacturer of soft drinks and spring water, servicing major retailers like Waitrose, Aldi, Tesco, Sainsbury’s, and Farm Foods. The company owns brands such as Perfectly Clear, Northumbria Spring, and Revolution Waves.

The acquisition brings Supreme’s non-vape annual sales to over £100 million. Clearly Drinks operates from a 150,000 sq. ft. site with natural spring water boreholes, capable of accessing up to 300 million litres of fresh spring water. Their facility is fully automated and includes a new can line with the capacity to produce 350 million canned drinks per year.

Clearly Drinks reported unaudited revenue of £22.4 million and an Adjusted EBITDA of £3.0 million for the year ending December 31, 2023, with further growth anticipated. The acquisition broadens Supreme’s product range and offers significant cross and upsell opportunities across its established customer footprint of supermarkets, discounters, and online retailers.

Supreme plans to leverage Clearly Drinks’ operational footprint through its vertically integrated distribution platform. The acquisition facilitates further product extension within Supreme’s established Sports Nutrition & Wellness category, aiming to produce wellness and energy drinks.

The deal was completed on a cash-free, debt-free basis, funded from Supreme’s free cash. Sandy Chadha, Chief Executive Officer of Supreme, expressed delight over the acquisition, seeing it as a significant component of Supreme’s broader diversification strategy. He emphasised the opportunity to capitalise on cross and upsell opportunities facilitated by Supreme’s trusted reputation across the UK retail space.

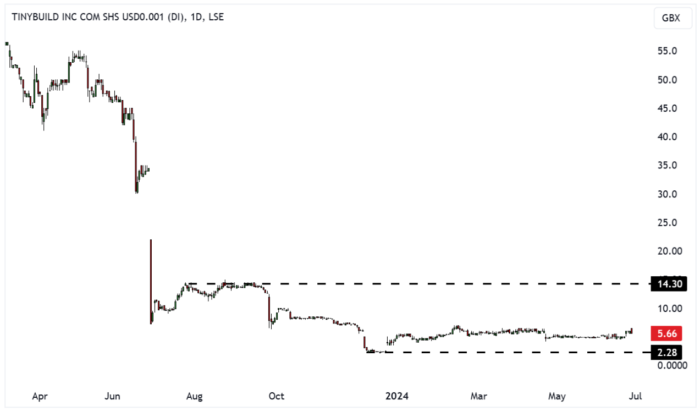

tinyBuild reports strong sales and positive outlook for 2024

Video games publisher and developer, tinyBuild (TBLD) has released a trading update and announced the publication of its Annual Report for the year ending 31 December 2023.

Key highlights included sales slightly ahead of expectations for the first five months of 2024 and a strong performance of their game pipeline, particularly at Steam Next Fest. The company holds mid-to-high single-digit cash levels as of May 2024 and recently sold the IP for Surgeon Sim to Atari.

Despite industry challenges and underperformance of some titles like Broken Roads, tinyBuild is managing its catalogue carefully and investing in new high-potential IPs. The company’s release schedule is heavily weighted towards the second half of the year, with significant wishlist growth indicating future sales potential.

The outlook for tinyBuild remains positive, with a strong pipeline of upcoming games and continuous investment in their catalogue. The company remains cautious due to the conflict in Ukraine and the macroeconomic situation but is confident in meeting its expectations for the year.

Tracsis fall on disappointing trading update amid UK election impact

Earlier this month, Tracsis (TRCS) experienced a drop in its share price following an underwhelming trading update…

The update revealed that the company’s financial performance was impacted by unexpected external factors, notably the early announcement of the UK general election. The election timing led to pre-election activity restrictions, affecting decision-making and spending by central government, local authorities, and Train Operating Companies within the UK transportation sector. These restrictions caused delays and rescheduling of projects, as well as a short-term reduction in new order activity anticipated for the final quarter of Tracsis’ financial year.

Additionally, the update highlighted ongoing challenges in converting the North American pipeline into revenue before the fiscal year-end. Despite pursuing these opportunities, the expected revenue from this region will not be realised within the current financial year.

As a result of these combined factors, Tracsis revised its revenue guidance for FY24 downwards to £80.0m – £82.0m, compared to previous analyst consensus estimates of £84.0m – £85.9m. The adjusted EBITDA margin was projected to be slightly above the 15.5% reported for the first half of the year, yet still below market expectations.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.