29th May 2024. 9.06am

Regency View:

BUY Whitbread (WTB)

- Growth

- Value

Regency View:

BUY Whitbread (WTB)

Time to snap up Whitbread

In a market that’s surged to new highs, valuations become toppy and unloved stocks stand out like a sore thumb. Of course, it would be foolish to assume that unloved stocks showing relative weakness equate to good value, but in the case of Whitbread, we believe the time is right to snap up the shares.

Shares in the Premier Inn owner have tumbled more than 19% this year versus a 7% gain on the FTSE 100 (YTD). This performance is nothing short of dismal, and the collective intelligence of the market is underestimated at your peril. However, the quality of Whitbread’s brands, its strategic positioning, and operational reforms should see investors who buy the stock at current levels be rewarded over the long term.

Strength in performance and strategic positioning

Despite recent market underperformance, Whitbread has demonstrated remarkable strength in its core operations…

Premier Inn UK delivered record-adjusted pre-tax profits of £588 million, highlighting a robust return on capital employed (ROCE) of 15.5%. This positions Whitbread as a leader in the UK midscale and economy hotel market, outperforming its peers and showcasing its operational efficiency.

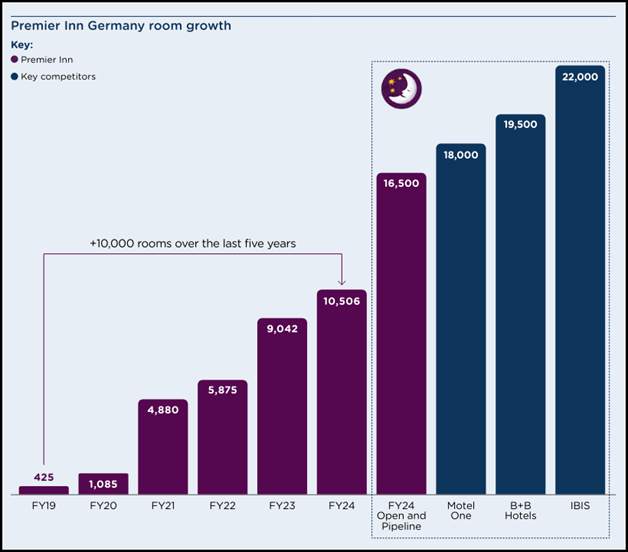

Moreover, Whitbread’s German expansion strategy is beginning to pay off. Although Premier Inn Germany reported an adjusted pre-tax loss of £36 million, this is a significant improvement from the previous year’s £50 million loss. The German market also saw a 62% increase in revenue, with revenue per available room (RevPAR) up by 20%. As Whitbread continues to build brand awareness and refine its operations in Germany, the path to profitability in this burgeoning market becomes clearer.

Revamping food and beverage strategy

Whitbread’s Accelerating Growth Plan (AGP) is a testament to its proactive and innovative approach. By optimising its food and beverage (F&B) offerings, Whitbread plans to divest 126 underperforming sites and convert 112 restaurants into hotel rooms.

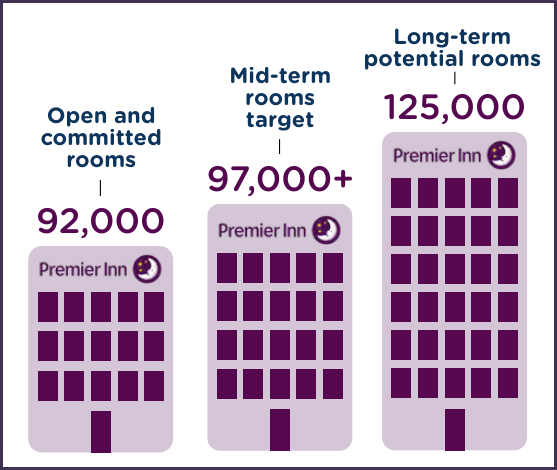

This strategic manoeuvre is expected to unlock 3,500 new room extensions, aiming for a total of 97,000 rooms by 2029. The £500 million investment required for this transformation will be funded through existing capital expenditure, ensuring a sustainable and profitable growth trajectory.

The AGP is projected to deliver incremental adjusted pre-tax profits of £30 million to £40 million by 2027, rising to £80 million to £90 million by 2029. This strategic realignment not only enhances operational efficiency but also promises to drive long-term shareholder value.

Robust financial health and shareholder returns

Whitbread’s financial metrics underpin its resilience and growth potential. For the fiscal year ending February 2024, the company reported revenue of £2.93 billion, a 13% increase from the previous year. Adjusted pre-tax profits were in line with market expectations at £561 million, underscoring the company’s robust performance amidst challenging market conditions.

The company maintains a healthy leverage ratio of 2.9 times lease-adjusted net debt to adjusted EBITDA, comfortably within its covenant ratio threshold of 3.5 times. This conservative leverage ensures financial flexibility and mitigates risk, allowing Whitbread to navigate economic fluctuations effectively. Furthermore, the company generated strong free cash flow, enabling substantial returns to shareholders. This is evidenced by a 26% increase in the final dividend per share to 62.9p and a £150 million share buyback program set to be completed in the first half of the current financial year.

From a valuation perspective, Whitbread’s shares currently trade at an enterprise value to EBITDA (EV/EBITDA) multiple of six times, significantly below its five-year average of 16 times. This discrepancy suggests that the market is undervaluing Whitbread’s potential. When compared to peers like InterContinental Hotels Group (IHG) and PPHE Hotel Group (PPH), which trade at higher multiples, Whitbread’s current valuation appears unjustifiably low.

Technical analysis: A compelling entry point

From a technical perspective, Whitbread shares present an attractive entry point. The recent pullback has brought the shares to a confluent area of long-term support. This support is reinforced by the volume-weighted average price anchored to the 2020 lows, swing support, and the ascending trendline intersecting the 2020 and 2022 lows. This convergence of technical indicators suggests a strong foundation for potential upward movement, offering investors a favourable risk-reward ratio.

In the face of recent underperformance, we believe Whitbread offers compelling value. The company’s strong operational performance, strategic growth initiatives, robust financial health, and attractive technical positioning make it a prime candidate for long-term value creation.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.