9th May 2024. 8.57am

Regency View:

BUY Wynnstay (WYN)

Regency View:

BUY Wynnstay (WYN)

Harvesting returns: Wynnstay’s yield in agriculture and investing

Income investing and farming share a common thread: both revolve around the concept of yield.

Just as farmers cultivate their crops with the expectation of a fruitful harvest, income investors seek to cultivate their investment portfolios with the expectation of a steady stream of income. In both domains, reliability and sustainability are paramount.

Enter Wynnstay (WYN), a cornerstone in the agricultural industry. Wynnstay embodies the principles of reliability and sustainability, offering essential products and services to support farmers in their quest for a bountiful yield.

For income investors, Wynnstay’s impressive track record of delivering reliable dividends offers a fertile environment for generating a substantial yield.

Wynnstay’s role in sustainable agriculture

Wynnstay plays a crucial role in supporting farmers across the UK in their efforts to cultivate crops and raise livestock sustainably. The company operates across several key segments:

Feed: Wynnstay manufactures and supplies feeds for various farm livestock, ensuring that farmers have access to high-quality nutrition for their animals. Additionally, it supplies feed raw materials to both farmers and other manufacturers in the agricultural industry.

Arable: In this segment, Wynnstay provides processed seeds, fertilizers, and agrochemicals to support crop cultivation. The company also offers grain marketing services, assisting farmers in selling their produce effectively.

Glasson: The Glasson division trades feed raw materials, manufactures specialist feed products, and produces blended fertilizers, catering to the specific needs of farmers.

Youngs Animal Feeds: This division specialises in the manufacture and distribution of equine products, which are sold across Wales and the Midlands. It operates through three Youngs Animal Feeds depots.

Wynnstay Depots: With a network of 53 depots, Wynnstay provides essential products and services to farmers and the wider rural community. These depots serve as key hubs for agricultural supplies and expertise.

The company’s routes to market include Wynnstay Depots, delivery services to farms, expert advisors, and a digital platform.

Cyclical business with shares towards the bottom of the cycle

The agricultural industry tends to be cyclical where its financial performance is inherently linked to various external factors such as weather patterns, commodity prices, and agricultural policies. As a result, Wynnstay experiences fluctuations in revenue and profitability over different phases of the economic cycle.

The are several factors that indicate Wynnstay may be nearing the bottom of the cycle:

1. Industry challenges: The agricultural sector has encountered numerous hurdles in recent times, including adverse weather conditions, fluctuating commodity prices, and uncertainties surrounding government policies. These challenges have created headwinds for Wynnstay and its peers, impacting demand for agricultural products and services.

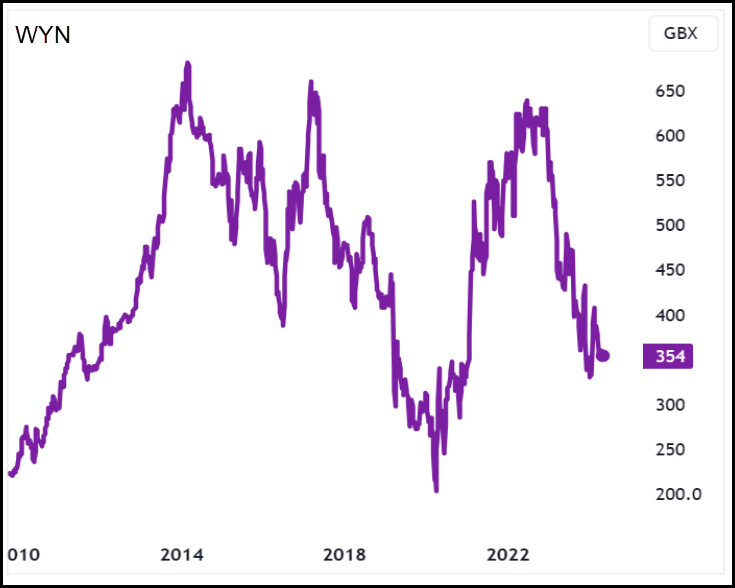

2. Historical performance: Wynnstay’s share price has declined by more than 40% from its previous highs, indicating a significant correction in valuation. Such a substantial drop suggests that the shares may have reached a trough in their cycle, potentially signalling a turning point for the company’s financial performance.

3. Recovery potential: Despite the current challenges facing the agricultural sector, there are signs of potential recovery in the medium to long term. Improving commodity prices, government support programs, and seasonal trends should contribute to a rebound in demand for Wynnstay’s products and services.

Overall, while Wynnstay’s business cycle may be experiencing a downturn, there are indications that the company is nearing the bottom.

Reliable income generator

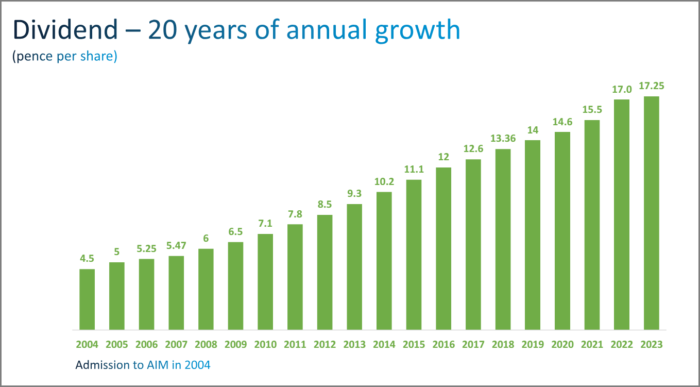

Wynnstay has a track record of maintaining a stable dividend payout, reflecting its commitment to creating value for shareholders. Despite market fluctuations, the company has remained steadfast in its dividend distributions, providing investors with a dependable income stream.

One of Wynnstay’s key strengths is its ability to grow dividends over time. By consistently increasing dividend payments, the company enhances shareholder returns and reinforces its financial stability. This dividend growth aligns with investors’ objectives of preserving and growing their wealth over the long term.

With a forecast dividend yield of 5.2%, Wynnstay offers investors an attractive income opportunity, especially in today’s low-yield environment. The dividends are well-supported by its earnings, with a dividend cover ratio of 1.9 times for the most recent fiscal year. This indicates that the company generates sufficient earnings to sustain its dividend payments, providing assurance to investors regarding the stability and reliability of its dividends.

The company’s business model generates stable cash flows, which support its dividend payments. This resilience in cash flow generation underscores the sustainability of Wynnstay’s dividend policy.

Additionally, Wynnstay’s shares trade at an attractive valuation, with a relatively low price-to-earnings (PE) ratio of 9.4. This implies that investors can acquire ownership in the company at a reasonable price relative to its earnings potential, enhancing the attractiveness of its dividend.

In summary, Wynnstay emerges as a top dividend stock due to its consistent dividend track record, dividend growth prospects, attractive yield, robust dividend cover, stable cash flows, and compelling valuation. For investors seeking reliable income and long-term capital appreciation, we believe Wynnstay represents a compelling choice.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.