25th Apr 2024. 9.01am

Regency View:

Buy Billington (BILN) – Second Tranche

Regency View:

Buy Billington (BILN) – Second Tranche

Billington: Adding to strength

A key aspect of successful long-term investing is having the conviction to add to strong stocks that are delivering on your expectations.

Too many investors will average down on stocks that are moving against them. This often leads to building larger positions in your weakest stocks. While ‘averaging up’ can seem counterintuitive, the best stocks, by definition will get progressively stronger over time.

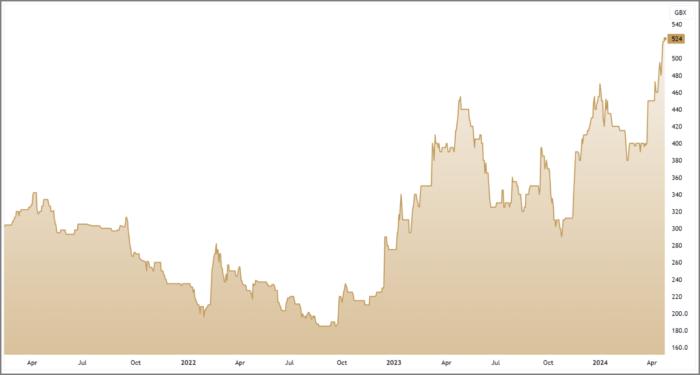

We first recommended structural steel company, Billington (BILN) back in November last year. Since then, the business has gone from strength to strength, winning its largest single contract in its history and delivering market-beating full-year results.

Whilst the shares have rallied some 30% since our original recommendation, we believe Billington’s valuation remains highly attractive given the company’s quality and momentum.

Securing historic contracts

In March, Billington announced that it had secured its largest single contract in its history, marking a pivotal moment for the company. This achievement underscores Billington’s reputation as a leading player in the structural steel and construction safety solutions sector.

The six new contracts, totalling approximately £90 million, represent a substantial leap forward for Billington, both in terms of scale and significance. Notably, these contracts span diverse sectors, including power generation, manufacturing, and retail logistics, highlighting Billington’s versatility.

This landmark accomplishment has propelled Billington’s order book to unprecedented levels, surpassing previous records and instilling confidence in the company’s future prospects.

Exceptional full-year results

Earlier this month, Billington published an exceptional set of results for the year ended 31 December 2023…

Highlights included record-breaking revenue of £132.5 million, marking a significant increase of 53% compared to the previous year. Billington managed to more than double profit before tax to £13.4 million, up from £5.8 million in 2022.

With a strong cash balance of £22.1 million at year-end and the Group becoming debt-free, Billington’s financial power has increased despite challenging macroeconomic conditions. The recommended dividend of 33 pence per share, including an additional exceptional amount reflective of the outstanding performance, underscores Billington’s commitment to rewarding its shareholders.

Group CEO, Mark Smith expressed confidence in the company’s future outlook, stating:

“2023 was an exceptional year for Billington, with an excellent trading performance across the Group, despite continuing macroeconomic challenges and against the backdrop of demand for structural steel in the UK remaining at a similar level to 2022.”

Smith added, “Whilst there inevitably remain further challenges ahead and market uncertainties are likely to remain for some time, the Group has made significant investments for the future and currently has a record order book. I am therefore confident that with our strong balance sheet and order book Billington will continue to perform well and in line with current market expectations.”

Valuation remains attractive

Despite its recent successes, Billington’s share price continues to trade at eye-catchingly low levels.

The stock is currently trading at a forecasted PE ratio of 9.8, indicating that it is undervalued relative to its earnings potential. Additionally, its price-to-book value and price-to-sales ratios of 1.41 and 0.51, respectively, suggest that the stock is attractively priced compared to its assets and sales.

Of particular note is that Billington trades at a large discount to its estimated fair value, representing a 25.8% reduction from its intrinsic worth. This substantial discount supports our view that averaging up on our position is a worthwhile strategy.

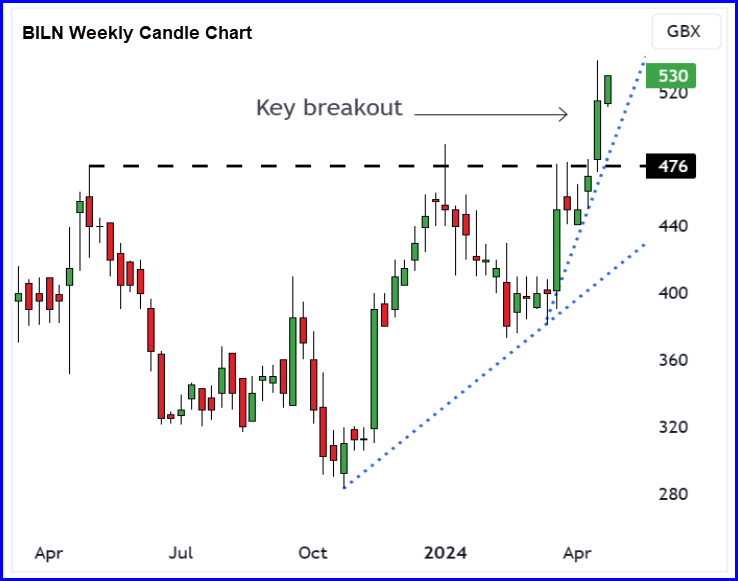

Technical timing: Ride the breakout

Billington’s contract wins and strong full year results have propelled the shares above a key level of long-term resistance at 476p.

This decisive breakout is best viewed on the weekly candle chart (right). The breakout has two key implications:

1. New highs: The breakout has taken the shares to new highs. This opens the door for a more substantial trending move higher as there is no resistance holding the stock back.

2. New support: A key characteristic of uptrends is broken resistance turning to support. Hence the breakout now adds an additional layer of support to Billington’s price chart.

The momentum of Billington’s share price is matched by the underlying quality of its financials. And whilst the stocks valuation remains attractive, we’re more than happy to snap up a second tranche.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.