12th Apr 2024. 9.52am

Weekly Briefing – Friday 12th April

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.35% |

| FTSE 250 | +1.19% |

| FTSE All-Share | +1.32% |

| AIM 100 | +3.36% |

| AIM All-Share | +3.03% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 12th April

Market Overview

Dear Investor,

Inflation, much like jam stubbornly clinging to a woollen jumper, is proving to be remarkably resistant to efforts to shake it loose. This stickiness has left central bankers and politicians alike scrambling to find effective solutions, especially as election season approaches.

This week’s release of US inflation data only adds to the tension of the situation. With consumer prices rising by 3.5% for the year to March, surpassing expectations, the pressure on central bankers and politicians has intensified.

Markets now anticipate rate cuts may not occur until after the November 5 election, with fewer cuts expected than previously forecasted. Biden called on corporations to lower prices, criticising congressional Republicans for allegedly enabling price hikes.

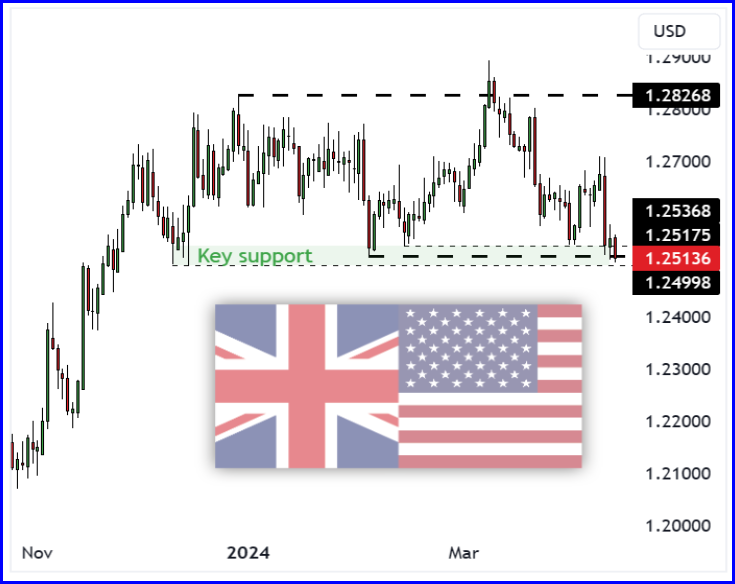

Bond yields increased, stocks fell, and the US dollar strengthened across the board, taking GBP/USD back to 4-month lows.

Fed officials remain divided on the inflation outlook, with some expressing concern about persistent inflationary pressures. Despite the Fed’s initial projections, recent comments from regional Fed presidents suggest doubts about the feasibility of multiple rate cuts this year.

As central bankers and politicians grapple with the stubbornness of inflation, the theme of ‘higher for longer’ appears set to define the landscape for 2024.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: IQE (LSE:IQE) +54.3% on the week

Apple supplier IQE saw a surge in its stock price this week following the release of its promising fiscal 2024 forecast.

IQE anticipates its revenue for the year ending December 31, 2024, to fall within the range of £133.7 million to £153.7 million, with an adjusted core profit estimated between £11.1 million and £16.6 million. This optimistic outlook from IQE’s management buoyed investor confidence, leading to increased demand for the company’s shares.

Furthermore, IQE highlighted an improving order book, particularly driven by the growing demand in the artificial intelligence (AI) industry. This positive development signals potential revenue growth opportunities for the company, further reinforcing investor sentiment.

Americo Lemos, IQE’s CEO, expressed satisfaction with the company’s resilience, especially considering the challenges faced by the semiconductor industry in 2023. Lemos said IQE is well-positioned within the global value chain to achieve sustainable growth and capitalise on opportunities in 2024 and beyond.

REGENCY VIEW:

IQE’s positive outlook has boosted the stock’s short-term momentum, but long-term investors should remain cautious. The company has struggled to achieve top line growth and remains some distance from profitability. We tend to avoid cash burning stocks as they tend to dilute shareholders over time.

Cornish Metals share price has broken to new lows this week as investors continue to price in the impact of CEO Richard Williams departing at the end of March.

The company seeks a new CEO to guide them through the construction phase of the South Crofty tin mine project in Cornwall.

Additionally, the company accelerated refurbishment plans for the New Cooks Kitchen shaft at South Crofty, reallocating funds raised in a 2022 fundraiser to accommodate the work and expedite mine development.

Ken Armstrong, a non-executive director, is serving as interim CEO, while Patrick Anderson, the chairman is acting executive chairman while Cornish Metals seek a permanent replacement.

The shares are down -25% year-to-date, dramatically underperforming the wider mining sector.

REGENCY VIEW:

Cornish Metals share price reflects the dangers of investing in pre-revenue cash-burning businesses. The shares have tumbled -75% from their December 2021 highs, leaving those who bought into the hype feeling battered and bruised.

Whilst Cornish Metals balance sheet is well capitalised, the stock does not meet enough of our criteria to warrant consideration for investing.

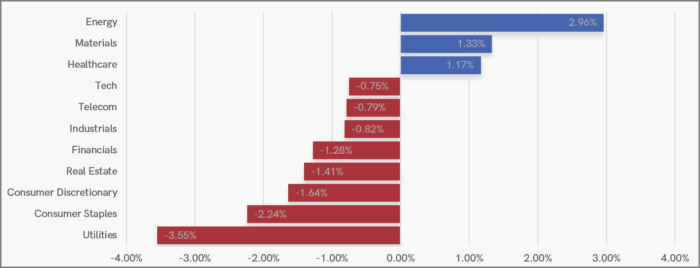

Sector Snapshot

For a second consecutive week our UK sector snapshot reflects investors concerns that inflation will remain stubbornly high.

Inflation hedges are making gains with Energy and Materials topping the charts. While sectors that perform poorly in high inflation / high interest rate environments, such as Real Estate and Consumer Staples continue to perform poorly.

UK Price Action

It’s been a second consecutive week of sideways consolidation for the FTSE as the index coils beneath all-time highs.

Given FTSE’s current trend structure, this current consolidation phase looks bullish and we still expect the market to retest the February 2023 in the coming weeks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.