22nd Mar 2024. 11.25am

Weekly Briefing – Friday 22nd March

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +2.80% |

| FTSE 250 | +1.21% |

| FTSE All-Share | +2.53% |

| AIM 100 | +0.83% |

| AIM All-Share | +0.56% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 22nd March

Market Overview

Dear Investor,

Central banks took centre stage this week as rate decisions and economic forecasts came into sharp focus on both sides of the Atlantic.

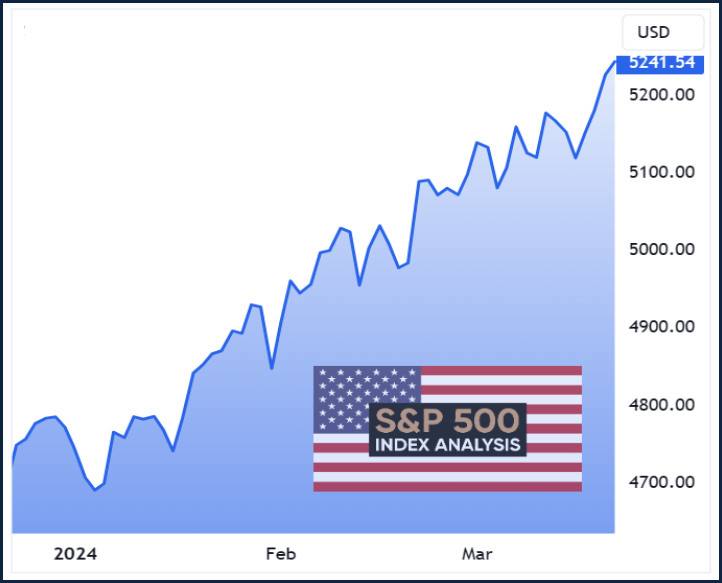

Up first was the US Federal Reserve on Wednesday. Officials unveiled a cautiously optimistic outlook amidst the backdrop of a robust US economy. Despite acknowledging slightly hotter underlying inflation, the Fed remained steadfast in its commitment to lowering interest rates, aiming for up to three quarter-point cuts throughout the year.

This decision triggered a surge in US equity markets, with the S&P 500 and Nasdaq Composite reaching record highs. Government bond prices rose as yields fell.

Across the pond, the Bank of England held its benchmark interest rate at 5.25% on Thursday, signalling a slight divergence in monetary policy strategies compared to its US counterpart.

Governor Andrew Bailey acknowledged positive developments in inflation but underscored that the UK economy wasn’t yet at the point to warrant rate cuts. However, the bank’s language indicated a shift in tone, suggesting that future meetings would actively consider the possibility of rate cuts.

This stance was reflected in market expectations, with traders pricing in three potential rate cuts this year and the FTSE’s surging higher. While the Bank of England will insist that it is cautiously navigating its own path, traders expect the bank to revert to type and ‘follow the Fed’ as and when it cuts rates.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Next (LSE:NXT) +6.8% on the week

UK retailer Next surged higher this week as it anticipates achieving record profits of almost £1 billion this year.

This optimistic projection is primarily attributed to an increase in consumer spending, fuelled by higher wages. Lord Simon Wolfson, the CEO of Next, typically known for his cautious approach, expressed uncommon positivity during the announcement.

Reiterating its profit forecast, Next highlights the encouraging consumer environment characterised by wage growth outpacing inflation. This positive trend comes after a period of economic strain on household budgets, indicating a potential rebound in consumer confidence.

Despite acknowledging the existence of uncertainties in the market, Next maintains a bullish outlook. The company observes a shift in consumer preferences towards investment dressing, alongside a disciplined approach to managing costs. However, Next also acknowledges potential challenges in the broader economy, particularly concerning employment opportunities amidst rising wages.

Investors have responded positively to Next’s outlook, as evidenced by the significant surge in the company’s share price, which has risen by 30% over the past year.

REGENCY VIEW:

Next has earned praise for its ability to swiftly adapt to the changing landscape of retail, particularly with the shift towards online shopping. The company has demonstrated adept crisis management strategies, distinguishing it from its competitors.

The shares trade on a premium valuation 15x forward earnings. This looks high relative to its peer group, the wider market, and forecasted growth in earnings per share of less than 10%.

Hummingbird Resources, an Africa-focused gold producer, is encountering fresh challenges at its Kouroussa gold mine in Guinea due to disputes with one of its main contractors, Corica Mining Services.

The contractor halted activities, citing various contractual disagreements, which Hummingbird considers a breach of the mining contract. Hummingbird demanded the resumption of mining operations by Corica or threatened to step in or work with alternative suppliers. Corica claims Hummingbird owes $27 million for completed work, contingent on payment and providing a guarantee by April 7.

Hummingbird disputes the amount owed and the necessity of payment, citing Corica’s consistent underperformance since the contract’s inception in September 2022. Despite cooperating with Corica since July 2023, Hummingbird alleges delays in mobilising equipment, commissioning, and recruitment, leading to underperformance.

Kouroussa mine, Hummingbird’s second operating mine, achieved first gold pour in June 2023, with production projected to average 120,000 to 140,000 ounces annually for the initial three years and 100,000 ounces annually over seven years thereafter.

To manage debt, Hummingbird secured a $55 million loan with Coris Bank and aims to reduce $122.8 million in debt over three years, starting with a $77 million repayment by year-end. Additionally, the company raised $30 million through a share placement, mainly with its shareholders, including a 45% stakeholder, CIG.

REGENCY VIEW:

Hummingbird’s issues highlight the risks involved in investing in small-cap mining and exploration companies. We believe these type of stocks should always form part of balanced and diversified portfolio.

Sector Snapshot

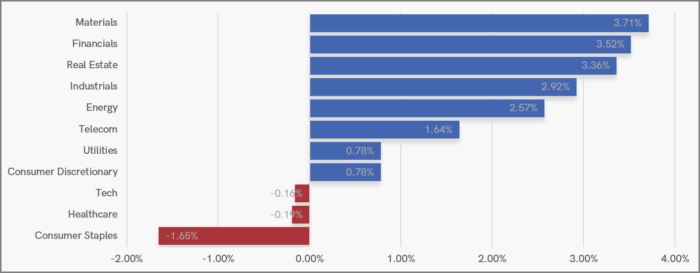

With UK stocks surging higher, it’s no surprise that our UK Sector Snapshot is a sea of blue this week.

An interesting point to note is that we have traditionally ‘risk on’ sectors such as Materials, Financials and Real Estate leading the market higher. This suggests that this week’s breakout is backed by an increasing desire to assume risk – indicating that the rally may have further to run.

UK Price Action

It’s been a long time coming, but the FTSE finally broke decisively above resistance this week. However, as one resistance zone disappears into the distance, another potentially more significant one comes into sharp focus. The May 2018 highs at 7,916 were briefly surpassed in February last year which printed a high of 8,045, these two highs represent the next major barrier for the UK’s headline stock index.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.