17th Nov 2023. 10.49am

Weekly Briefing – Friday 17th November

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.72% |

| FTSE 250 | +4.12% |

| FTSE All-Share | +2.08% |

| AIM 100 | +2.35% |

| AIM All-Share | +2.29% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 17th November

Market Overview

Dear Investor,

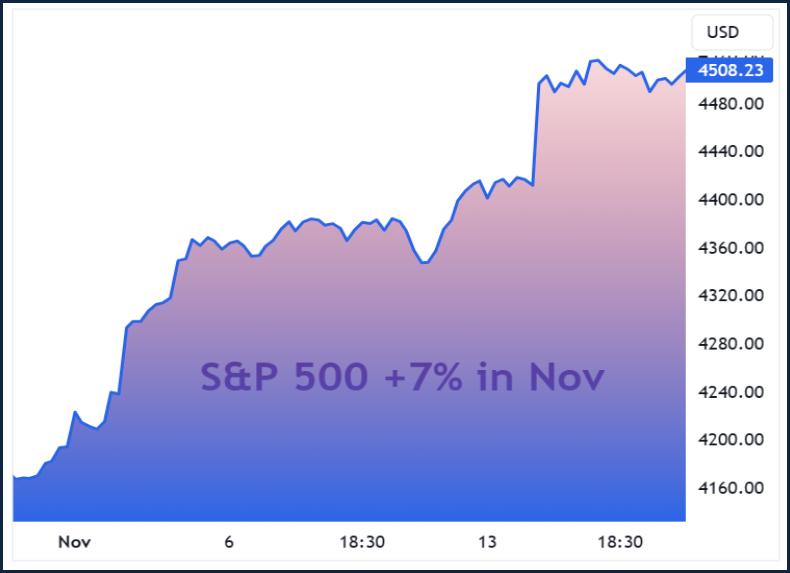

Stocks on Wall Street rallied sharply this week after US inflation fell more than expected to 3.2% in October.

The 3.2% year-on-year figure was also marginally below expectations of 3.3% and shows a drop from 3.7% in September. In response, the S&P 500 rose 1.9%, its biggest one-day jump since April, while the Nasdaq Composite soared by 2.4%, and the dollar index weakened 1.5%.

Following the US data, there was a noticeable decline in UK inflation as well. The UK’s core consumer price index fell to 5.7% in October from 6.1% in September. Meanwhile, in the eurozone, inflation dropped to 2.9% in the 12 months leading to October, down from the 4.3% recorded in September.

These more favourable inflation figures are sparking talks that central banks like the Fed, the European Central Bank, and the Bank of England might have completed their series of rate hikes.

Post Tuesday’s report, the futures markets projected a zero chance of the central bank raising rates at its upcoming policy meeting in December. What’s more, investors are already anticipating the Fed making moves to cut rates, with expectations set for two 0.25 percentage point cuts by July.

With inflation cooling off, investors are eagerly hoping for the stage to be set for a ‘Santa Rally’!

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Experian (LSE:EXPN) +9.6% on the week

Experian topped the FTSE’s highest risers this week after posting a market-beating set of first-half numbers.

Experian’s revenue from ongoing activities climbed by 6% to $3.41 billion during the six-month period. First-half profit hit $928 million, propelled by heightened consumer demand for affordability assessments and investment portfolio analysis during the cost-of-living crisis.

The company’s success reflected positively in stock performance, with shares of Experian rising by 5.5% to 2,830 pence, marking it as the top gainer on London’s FTSE 100 index following the release of its results.

Experian attributed its positive results to growth across all regions. Latin America experienced double-digit growth, North America demonstrated improvement by focusing on new revenue streams and analysis tools, while EMEA and Asia Pacific showed signs of improvement, and the UK and Ireland sustained steady growth.

In North America, the company adapted its strategy to emphasise revenue streams like new datasets and analysis tools, offsetting the impact of stricter lending standards. Meanwhile, British lenders are increasingly seeking comprehensive financial data due to heightened concerns about borrowers managing debts in a high-interest rate environment.

REGENCY VIEW:

We believe Experian are perfectly positioned to ride the ‘big data boom’. Click here to read our full report on Experian here.

Kainos share fell sharply this week after a downturn in overall booking overshadowed a jump in revenue and profit.

The Belfast-based software company reported a 12% increase in pre-tax profit, reaching £30.9 million, accompanied by a 7% rise in revenue, totalling £193.2 million. However, the downturn in overall bookings, falling by 9% to £201.9 million, raised concerns among investors, contributing to a 20% drop in the shares on Monday.

At the divisional level, revenues in Digital Services nudged down 1% to £109.2m. The company said strong public sector revenue growth of 17% was offset by a 32% drop in healthcare revenue to £20.5m.

Meanwhile, the Workday Services division saw revenue growth of 18% to £57.3m and Workday Products revenues were up 28% at £26.7m.

Chief executive Russell Sloan commented:

“Workday Products division continues to gain momentum. In addition to our three established Smart Suite products, we are delighted to have launched our latest product, Employee Document Management, which already has nine international clients signed up. We are confident that we will have further opportunities to develop new, innovative products as we continue to help ambitious clients deploy Workday.”

REGENCY VIEW:

Kainos is a high-quality business, consistently generating strong cash flow with impressive growth rates and solid margins. However, despite a 30% drop in its share price this year, the stock remains relatively expensive, trading at a sector-high forward price-to-earnings multiple of 20.1. This valuation appears steep compared to the forecasted earnings growth of 19%, making it a challenging choice for investors seeking a more reasonable valuation.

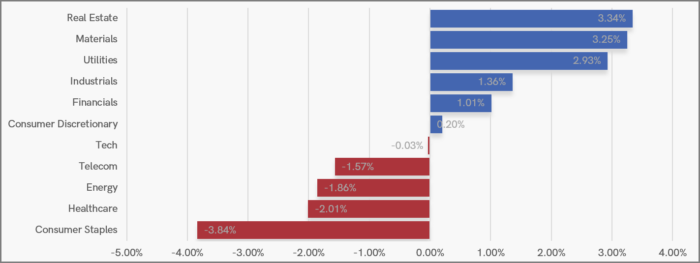

Sector Snapshot

With inflation on both sides of the Atlantic coming in weaker than expected this week, it’s no real surprise to see Real Estate and Materials top of the charts.

Consumer Stapels are bottom this week with several stocks giving back gains from a strong performance during earnings season.

UK Price Action

It’s been a frustrating week for FTSE bulls having to watch US and European stocks surge higher while the UK market struggles to generate momentum.

Wednesday’s break above swing resistance could not be maintained and having briefly tested the broken wedge pattern, prices have retreated. Another failure at 7,483 resistance could trigger a deeper sell-off and see the market retest the October lows.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.