15th Nov 2023. 9.00am

Regency View:

Update

Regency View:

Update

ABF surge higher on surprise special dividend

Our recent buy recommendation in Associated British Foods (ABF) is off to a flying start after the diversified food and retail conglomerate delivered a market-beating set of Annual Results.

ABF’s share price surged to new trend highs following the announcement of a surprise special dividend, a £500 million share buyback, and robust trading at its discount fashion chain Primark.

ABF reported annual results that exceeded previous guidance, showing a 16% increase in group revenue to £19.8 billion and a 9% rise in adjusted pre-tax profit to £1.47 billion. The company attributed this success to price hikes across its businesses to combat inflation.

Primark, experienced a 17% rise in annual revenues to £9 billion, with like-for-like sales growth of 8.5%. Despite a 3% decrease in adjusted operating profit to £735 million, the company’s CEO, George Weston, described Primark’s performance as excellent under the circumstances, emphasising the brand’s attractiveness to both existing and new customers.

The conglomerate’s sugar business, particularly in Africa with Illovo, showed improved profits. Grocery revenues, driven by international brands like Twinings, Ovaltine, and others, performed well, especially in the US. The UK’s Allied Bakeries also saw improved performance.

With strong cash generation and successful strategic initiatives, ABF is well-positioned for further growth and progress in the coming year.

Auto Trader profits jump on ‘record’ car buyer numbers

Auto Trader (AUTO) raced to the top of the FTSE’s highest risers last week after posting a strong set of Half Year results.

The online car dealerships operating profit margin remained stable at 71%, while the overall margin slightly dipped to 59%. Basic earnings per share grew by 4% to 12.74p, and cash generated from operations rose by 12% to £184.2 million. EBITDA increased by 9% to £182.1 million, and adjusted earnings per share climbed 2% to 13.96p.

The growth in average revenue per retailer by 12% was attributed to the adoption of additional products and services. Auto Trader expressed confidence in the second half, citing stable recurring revenue and successful execution of a first-half growth event. The integration of Autorama, a new car leasing firm, is underway, promising cost savings and anticipating volume growth.

Auto Trader’s CEO, Nathan Coe said:

“It has been a strong start to the year with more buyers spending more time and completing more of their car buying journey on Auto Trader.”

“We are working in partnership with record numbers of retailers and manufacturers, who are turning to our platform as the most effective and efficient way to source, price and sell their vehicles.”

“We remain confident in our long-term prospects given the strength of our business and the opportunities to deliver meaningful value for car buyers, customers, our people and shareholders.”

AstraZeneca enters weight loss market and boosts profit outlook

AstraZeneca (AZN) is set to enter the weight loss pill market by signing a licensing agreement with China’s Eccogene for an oral medicine (ECC5004).

AstraZeneca’s CEO, Pascal Soriot, emphasised the “enormous need” for obesity treatments worldwide. The drug, currently in early clinical trials, aims to be a pill-based alternative to current injectable treatments for obesity.

The agreement with Eccogene is valued at up to $2.01 billion, with an upfront payment of $185 million and additional payments of up to $1.83 billion depending on milestones. AstraZeneca’s move into the weight loss pill market comes as demand for Novo Nordisk’s injectable Wegovy has driven up shares by almost 50% this year, with competition intensifying.

AstraZeneca’s Q3 financial update saw quarterly revenues jump 6%, driven by strong demand for oncology and rare disease drugs, offsetting the decline in Covid-19 vaccine sales. The company has revised its yearly guidance, expecting total revenue (excluding Covid drugs) to increase by a low-teens percentage, and core earnings per share (EPS) to rise by as much as a high double-digit percentage.

Babcock secures £750m submarine infrastructure deal

British defence company Babcock (BAB) has signed a four-year contract worth £750 million ($915 million) to enhance infrastructure supporting the UK’s submarine fleet.

The deal includes upgrading the Devonport site in southwest England, involving the construction of a dock, logistics, and modern support facilities dedicated to servicing and maintaining the submarine fleet.

The initiative comes as part of a broader increase in military spending by Britain and other Western countries in response to geopolitical events, particularly Russia’s invasion of Ukraine in 2022. In March, Prime Minister Rishi Sunak announced a new phase of a submarine pact with the U.S. and Australia, known as AUKUS.

Defence Minister Grant Shapps emphasised the importance of maintaining the infrastructure supporting the world-leading submarine fleet. Babcock’s CEO, David Lockwood, highlighted that the investment would lead to the creation of 1,000 new construction roles, ensuring the company’s ability to continue delivering complex maintenance and life-extension programs.

In addition to plans to build new submarines under the AUKUS pact with the U.S. and Australia, Britain is also constructing the Dreadnought class of ballistic missile submarines. These submarines are intended to replace the existing Vanguard fleet starting from the early 2030s, marking a significant advancement in the country’s naval capabilities.

Indivior swings to loss despite strong Sublocade performance

Indivior (INDV) delivered a strong third quarter despite facing a cash outflow that led to a loss. Their Sublocade revenue soared by 55%, hitting $167m, although this gain was overshadowed by the company’s overall loss.

The pharma adjusted its full-year expectations for Sublocade upward and also made significant strides with the launch of Opvee and secured a contract with the US Biomedical Advanced Research and Development Authority (BARDA). Overall, their year-to-date net revenue increased by 21%, reaching $800m, with third-quarter revenue up by 17% to $271m.

However, Indivior faced a decline in cash and investments due to various outflows, including expenses related to acquisitions and litigation settlements – leading them to report a year-to-date loss of $63m compared to the previous year’s profit of $173m.

Indivior forecasts full-year revenue of $1.03 billion to $1.09 billion, an 18% growth from 2022. They also expect higher adjusted operating profit in 2023, assuming stable exchange rates.

CEO Mark Crossley expressed confidence in the team’s efforts, citing double-digit growth driven by Sublocade. He highlighted progress in strategic priorities, including product launches, pipeline strengthening, and settling antitrust litigation, providing more stability for shareholders.

Morgan Advanced Materials sees YTD sales growth despite cyber incident impact

Morgan Advanced Materials (MGAM) reported a positive year-to-date sales growth despite facing the impact of a “cyber incident” earlier in the year.

Sales for the first nine months of the year increased by 2.4% year-on-year on an organic constant-currency basis. Within this, thermal ceramics sales grew by 0.9%, electrical carbon sales were 6.5% higher, and technical ceramics sales experienced a robust 7.7% increase.

However, molten metal sales saw a decline of 7.2%, and seals and bearings sales were 5.4% lower compared to the previous year. This decrease was influenced, in part, by the phasing of armour orders. The recovery from the cyber incident, according to the London-listed group, has progressed as planned.

Looking ahead, MGAM maintains its outlook for full-year organic revenue growth at 2-4%. The company continues to benefit from “strong growth” in semiconductor, healthcare, and aerospace end-markets, offsetting weaknesses in European and Chinese industrial markets.

CEO Pete Raby commented:

“Our business is growing as anticipated, benefitting from our leading, differentiated positions in selected markets and despite the challenging environment, with inflation continuing to be more than offset by pricing.”

Raby also emphasised the board’s commitment to the financial framework, with increased investment in capacity for faster-growing segments and ongoing exploration of inorganic investments and opportunities for enhanced returns to shareholders.

Prudential’s new business jumps 37% to $2.1 billion

Prudential reported a robust performance in the first three quarters of its financial year, marked by a substantial 40% rise in new business volumes (annual premium equivalent sales) to $4.4 billion.

This growth, excluding the impact of exchange rates, was particularly pronounced in Hong Kong where sales increased for both Chinese Mainland visitors and domestic customers.

The new business profit also saw a significant uptick, rising by 37% to reach $2.1 billion. Impressively, underlying new business margins showed improvement over each of the three quarters, reflecting the company’s sustained positive momentum.

Prudential’s asset management arm, Eatspring, experienced net inflows of $2.1 billion. These inflows were driven by retail clients transitioning into higher-margin equity funds. However, the total funds under management fell from $221 billion to $216 billion due to market movements.

Despite acknowledging the persistently challenging environment, Prudential’s management expressed confidence in their continued momentum, specifically noting ongoing strength in new business profit as they entered the fourth quarter.

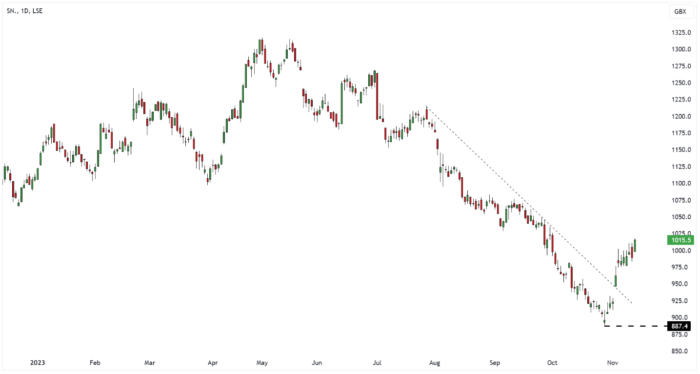

Smith & Nephew’s Q3 trading report reveals positive momentum

Smith & Nephew (SN.) reported Q3 revenue of $1,357 million, reflecting underlying growth of 7.7%.

In the Orthopaedics segment, revenue increased 8.3%, attributed to product launches and improvements from the 12-Point Plan. Trauma & Extremities, in particular, experienced significant growth.

Sports Medicine & ENT displayed robust performance, with an 11.1% increase in revenue. This growth was observed across most markets, compensating for weaknesses in China.

Advanced Wound Management posted a 3.6% revenue growth. The positive performance was supported by double-digit growth in the negative pressure portfolio.

The outlook for the full year 2023 indicates that underlying revenue growth is expected to be towards the higher end of the guided range of 6.0% to 7.0%. However, the trading profit margin is anticipated to be around 17.5%, reflecting challenges in the Chinese market.

The market reacted positively to Smith & Nephew’s trading update – causing the shares to gap higher. This burst of bullish momentum has snapped the downtrend which has been in place since the summer, and we will now be looking for the shares to start forming some higher swing lows.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.