20th Apr 2023. 8.58am

Regency View:

BUY RWS Holdings (RWS)

Regency View:

BUY RWS Holdings (RWS)

High quality RWS build acquisition war chest

When it comes to successful long-term investing, there’s few better strategies than buying quality at a discount.

Consistent cash generators that trade at a deep discount to historic and projected growth rates.

RWS Holdings (RWS) is a perfect example of this discounted quality approach…

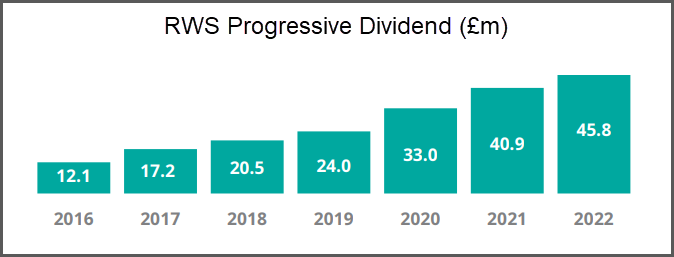

The translation specialist is extremely cash-generative, has a rock-solid balance sheet, and management has hiked the dividend for 19 years in a row.

This quality is not being reflected in a share price which trades at a 58% discount to estimated Fair Value and the stock has a PE less than half its five-year average.

Long-term catalysts underpin language services market

RWS remove language barriers for their global, blue-chip client base.

They do this through the provision of technology-enabled language, content management and intellectual property (IP) services.

RWS have an army of more than 2,000 linguistic experts allowing the business to support 429 language pairs and variations.

Trados Studio is RWS’ computer-assisted translation (CAT) tool which is used by more than 270,000 translators.

The Trados Studio software has neural machine translation (NMT) capabilities which uses the latest advances in the field of artificial intelligence (AI) to provide adaptable translation at scale.

There is no doubt that the use of AI technology will be key to driving innovation in the language services market. And some have argued that open-source AI like ChatGPT is a threat to businesses like RWS.

However, RWS’ blue chip client base, which includes 19 of the top 20 pharmas and 18 of the top 20 law firms, require very high levels of accuracy which means open-source AI is unlikely to pose a threat.

There are also several long-term catalysts which are likely to underpin demand for RWS services:

1. The increasingly complex regulatory landscape in the industries many RWS’ clients work in.

2. The improving internet availability in non-English speaking emerging markets.

3. The incremental rise of digitizing content and personalised international customer service.

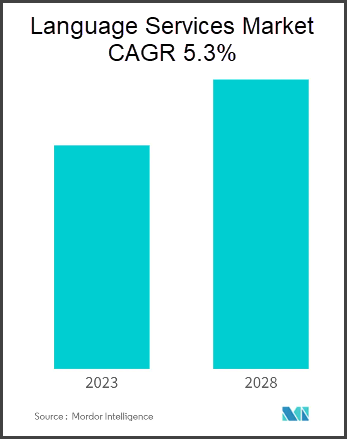

These factors are expected to see the global language services market grow at a compound annual rate (CAGR) of 5.3% over the next five years.

Gearing up for acquisitive growth

RWS is the second biggest player in the language services market but has less than a 2% share. This suggests there is plenty of scope for organic and acquisitive growth.

A key benefit of buying high-quality cash generative businesses like RWS is they can fund acquisitions without diluting investors.

RWS’ cash conversion ratio, it’s ability to turn cash into profits, sits at 110%. This has created a debt-free balance sheet with a net cash position of £110m.

And RWS plan to use this cash to take advantage of current market conditions which have seen businesses on a weaker financial footing get punished.

Ian El-Mokadem, RWS chief executive, said:

“We believe that the current environment presents an opportunity for us to strengthen our leadership in our markets, as a well-funded business of unique scale, sector diversification, footprint and capabilities”.

“In parallel, the group’s strong cash generation and balance sheet mean that we retain the ability and appetite to make strategically compelling acquisitions” he added.

Should RWS’s growth strategy start bearing fruit, the stock will be ripe for a rerating.

Locking in long-term value

Typically speaking, a stable cash generator like RWS would trade on a premium valuation and a PE north of 20 would not be unreasonable.

RWS’ five-year average PE is 26.5 – making its current forward-looking PE of 10.6 look very eye-catching.

Granted, there have been several factors which have contributed to a marked down valuation including the war in Ukraine impacting RWS’s Russian translation revenues and the introduction of a unitary patent across the EU.

However, we believe these factors are now priced-in and RWS’ strong and stable cash generation along with its plans to boost acquisitive growth leave the shares looking cheap.

The shares trade on a Price to Book Value of 1 and Price to Free Cashflow of 11.7, giving them one of the most attractive valuations in the Professional & Commercial Services industry.

And on a discounted cashflow basis, RWS currently trade on a 58% discount to estimated Fair Value.

Combine this with a steadily rising dividend, which currently offers a 4.42% forward yield, and RWS offer investors the chance to lock in some long-term value.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.