24th Oct 2025. 10.15am

Weekly Briefing – Friday 24th October

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +2.31% |

| FTSE 250 | +2.49% |

| FTSE All-Share | +2.32% |

| AIM 100 | +0.01% |

| AIM All-Share | +0.01% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 24th October

Market Overview

Dear Investor,

This week has been dominated by earnings from some of the world’s biggest brands and best-known stocks on both sides of the Atlantic. From Coca-Cola’s steady growth to Tesla’s margin squeeze, the updates painted a mixed picture of global demand, pricing power and investor confidence as we head into the final stretch of the year.

Coca-Cola showed once again why it remains one of the most dependable names in consumer staples. Revenues rose 5% in the third quarter, with price increases and strong demand for Coke Zero driving performance. The company maintained guidance and kept its upbeat tone, a reminder that even in tougher times, brand strength and distribution scale matter. Netflix also delivered record revenues above 11 billion dollars, powered by subscriber and ad growth, but a large tax expense in Brazil hit profits and prompted a sharp share price pullback. The market seems to be catching its breath after a long rally rather than losing faith in the business model.

In the UK, Barclays and Reckitt Benckiser both reported solid updates. Barclays saw profits dip 7%, but management countered with a 500 million pound buyback and an upgraded return on equity target. It is a confident move that suggests the bank feels firmly on track with its cost and capital plans. Reckitt, meanwhile, posted a reassuring trading statement as it continues to refocus on its higher-margin health and hygiene brands. The strategy is beginning to pay off, with double-digit growth in emerging markets providing welcome momentum.

Fresnillo’s production report offered a steady note from the mining sector. Gold output rose 8.8% year-to-date while silver declined, reflecting the planned wind-down of San Julián DOB. Management reaffirmed guidance and emphasised safety and efficiency, confident that strong metal prices can support another solid year. Across the Atlantic, Tesla’s update was less upbeat. Revenue growth returned, but margins fell as higher costs and competition from Chinese rivals continued to bite. Elon Musk’s personal stock purchases may have helped sentiment, but investors are increasingly focused on whether the company can maintain profitability as the EV market matures.

All told, this week’s updates underline a familiar theme. The companies that combined pricing power, efficiency and brand strength held firm, while those facing cost pressures or slowing demand struggled to excite. Coca-Cola and Reckitt showed the benefit of consistency, Netflix delivered growth but met reality, and Tesla reminded everyone that innovation still needs to translate into returns. The market’s message is clear: in 2025, solid execution counts for more than headline growth.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Eco Buildings (AIM:ECOB) +74.7% on the week

Eco Buildings surged more than 90% on Tuesday after securing a landmark €420 million contract with the Chilean Government to supply 20,000 modular homes under the country’s flagship social housing programme. The seven-year agreement marks the company’s first major commercial rollout in Latin America and establishes Eco as a key partner in Chile’s efforts to tackle its housing deficit. The first tranche of 607 homes is already allocated, backed by a 50% deposit of €12.75 million.

The contract follows a two-year approval process in Chile, one of the most stringent in the region, during which Eco completed extensive structural, acoustic and insulation testing to achieve full certification. With approval now in place, the company plans to set up a new manufacturing line in Chile by the second quarter of 2026 to meet growing demand, eventually scaling production to 5,000 homes per year.

Under Chile’s structured payment framework, Eco will receive 50% advance payments for each lot of homes, ensuring predictable cash flow and limited working capital exposure. The deal positions the AIM-listed modular housing specialist for further expansion across Latin America, leveraging its glass fibre reinforced gypsum technology, which offers faster and more cost-efficient construction suited to seismic regions.

REGENCY VIEW:

Eco Buildings remains a highly speculative micro cap despite this week’s surge. The Chile contract gives it long-term visibility for the first time, but with minimal cash, high gearing and a history of losses, execution risk remains extremely high. The next challenge will be turning orders into sustainable profit and cash flow.

Argo Blockchain shares dropped this week after the company announced plans to delist from the London Stock Exchange, retaining only its Nasdaq listing as part of a major restructuring. The move, set to take effect on 9 December, comes as the cryptocurrency miner battles to repair its balance sheet following a prolonged downturn in crypto markets. UK-based shareholders will keep their holdings but lose the regulatory protections of a London listing, a shift that has unnerved investors and sent the shares tumbling more than 40%.

As part of the restructuring, Growler Mining LLC, a key creditor and supplier of mining equipment, will convert debt into equity and take an 87.5% controlling stake in the recapitalised business. Bondholders will receive 10%, leaving existing shareholders with just 2.5% of the company’s equity. The deal underscores the severe financial pressure Argo has faced over the past year, with falling crypto prices and rising energy costs eroding profitability and forcing the business into survival mode.

Argo confirmed that it has already drawn $5.38 million from a $7.5 million loan facility with Growler to support short-term liquidity. The delisting and recapitalisation effectively mark a reset for the company, which hopes that focusing on its US operations and Nasdaq presence will offer a more stable foundation. However, for existing investors, the restructuring represents another painful chapter in Argo’s volatile history.

REGENCY VIEW:

Argo Blockchain remains a distressed micro cap fighting to stay afloat after years of heavy losses and collapsing crypto margins. The upcoming delisting and recapitalisation might give it breathing room, but with negative equity, persistent cash burn and minimal liquidity, this is a high-risk turnaround story that still feels one bear market away from oblivion.

Sector Snapshot

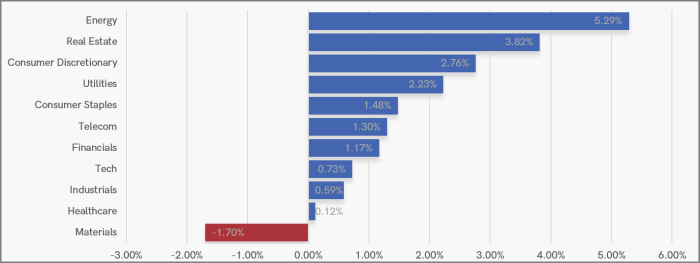

Energy surged to the top of the leaderboard this week, reclaiming its role as the market’s driving force after several quieter sessions. Real Estate and Consumer Discretionary followed with solid gains, while Utilities and Consumer Staples also strengthened, showing a healthy mix of cyclical and defensive participation.

At the lower end, Materials slipped into negative territory, pausing after a strong run, while the rest of the market posted modest gains. Tech, Financials and Industrials all edged higher, though the tone suggested investors were favouring areas with clearer near-term earnings visibility over pure growth exposure.

UK Price Action

In last week’s update, the FTSE was breaking below support, and we noted that if buyers could mount a recovery and drag the market back above that level before the close, it would suggest the uptrend remained in control. That’s exactly what played out… Friday’s session saw a strong recovery and a bullish pin-bar candle form, setting the tone for this week’s trading.

Since then, the FTSE has posted a steady push higher, reclaiming momentum and retesting the October highs. The recovery from the 9,350 support zone reinforces that dip buyers remain active, and as long as the market holds above that level, the broader uptrend continues to look healthy.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.