10th Oct 2025. 10.26am

Weekly Briefing – Friday 10th October

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.08% |

| FTSE 250 | -0.85% |

| FTSE All-Share | -0.04% |

| AIM 100 | -0.74% |

| AIM All-Share | -0.72% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 10th October

Market Overview

Dear Investor,

This week the “Takaichi Trade” has dominated global markets. The Japanese yen tumbled and Tokyo equities roared higher after Sanae Takaichi won the Liberal Democratic Party leadership race, putting her on track to become Japan’s first female prime minister later this month. Markets quickly moved to price in her reflationary agenda, betting that her government will favour large-scale fiscal stimulus and continued pressure on the Bank of Japan to maintain ultra-loose monetary policy. The result has been a surge in Japanese equities and one of the sharpest moves in USD/JPY in months.

For global equity investors, Japan’s rally has reignited global risk appetite. The Nikkei 225 jumped nearly 5% this week while the broader Topix index set fresh record highs, driven by strength across industrial, defence, and semiconductor stocks. The move reflects growing optimism that a Takaichi government could deepen strategic ties with the US and channel investment into areas such as defence, infrastructure, and technology. Financials, however, lagged as traders dialled back expectations for a Bank of Japan rate hike reminding investors that for now, Japan’s monetary policy remains firmly on the dovish side.

Currency markets have been equally active. The yen’s weakness has underlined the widening policy gap between the BoJ and the Federal Reserve, with USD/JPY surging through the symbolic ¥150 level before extending higher. For forex traders, this development has been pivotal. A weaker yen tends to support global liquidity conditions and risk sentiment, especially across emerging markets and cyclical assets, and the latest move has coincided with renewed strength in global equities. It also adds another dimension to the ongoing narrative of divergent central bank paths as Western policymakers begin to consider rate cuts while Japan continues to hold back.

In the commodity space, oil has been another major talking point. Brent crude appeared to break down last week but bounced back inside its range after OPEC+ announced a modest production increase of 137,000 barrels per day for November. The decision, far smaller than the half a million barrels rumoured ahead of the meeting, soothed market nerves and stabilised prices. While demand concerns and macro uncertainty continue to hover over the market, OPEC+’s cautious approach has reassured oil traders that the group remains committed to managing supply carefully rather than flooding the market.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Petro Matad (AIM:MATD) +44.2% on the week

Shares in micro-cap oil exploration company Petro Matad surged higher on Thursday following news that testing at its Gazelle-1 well in Mongolia had exceeded expectations. The AIM-listed firm said the well flowed oil to surface without artificial lift, achieving a stabilised rate of around 460 barrels of oil per day on its largest choke setting. No formation water was observed during testing, and oil gravity measured at 43º API was consistent with production from the company’s nearby Heron field. Petro Matad confirmed that Gazelle-1 will now be completed for production, with first oil targeted before the end of October.

The company said neighbouring operator PetroChina had made equipment available to help accelerate the completion and production start-up process. Due to the focus on bringing Gazelle-1 online, Petro Matad will delay testing at its Gobi Bear-1 well until next April when the 2026 operating window begins. Despite the postponement, management described the Gazelle-1 result as a priority, given its potential to meaningfully boost production and cash flow under the existing oil sales agreement with Block XIX.

Elsewhere, progress continues across other key projects. Pumping operations have begun at the Heron-2 well, where the new beam pump system is improving fluid recovery and reducing costs. Meanwhile, the electrification of the Heron-1 production facility has been completed, connecting it to the national grid and cutting operating costs by an estimated 15%. Chief executive Mike Buck said the team’s focus remains on maximising production efficiency and preparing both Heron and Gazelle for grid connection, which he described as “a significant step forward” for the company’s Mongolian operations.

REGENCY VIEW:

Petro Matad remains a high-risk, high-reward exploration play with small but fast-growing revenues and limited cash reserves. The Gazelle-1 success offers hope of turning years of losses into meaningful production, but with no profits yet and heavy reliance on operational milestones, it’s still one for the speculative corner of a portfolio.

On the slide

Mondi (LSE:MNDI) -17.5% on the week

Shares in packaging and paper company Mondi took a tumble this week after the group issued a profit warning and reported a sharp slowdown in core earnings growth for the third quarter. The company posted underlying EBITDA of €223 million for the three months to 30 September, down from €274 million in the second quarter and €290 million in the first, making it the weakest quarter so far this year. Mondi said subdued demand, lower selling prices and extended maintenance shutdowns across softer end markets had weighed heavily on performance.

The group now expects full-year 2025 EBITDA in the range of €1 billion to €1.05 billion, implying a reduction of up to 13% compared with previous forecasts. Management warned that challenging conditions would persist through the rest of the year as customer confidence remains fragile and markets continue to suffer from oversupply. Analysts at Jefferies described the downgrade as worse than expected and noted that the weak performance in uncoated fine paper had a negative read-across for the wider European paper and packaging sector.

Mondi said it was scaling back capital expenditure plans and delaying new strategic projects to focus on maintenance needs and cost reduction. The group expects contributions to EBITDA from major projects in 2025 to be around €30 million, well below earlier estimates. It also raised the synergy target from its recent acquisition of Schumacher to €32 million over three years and announced a reorganisation that combines its uncoated fine paper and corrugated packaging operations to streamline decision-making and drive efficiency.

REGENCY VIEW:

Mondi’s solid balance sheet and healthy dividend yield make it a steady hold, but profits are still under pressure from weak demand and soft pricing. Trading on just 10 times forward earnings, it looks cheap, yet investors may need to wait for margins to pick up before confidence returns.

Sector Snapshot

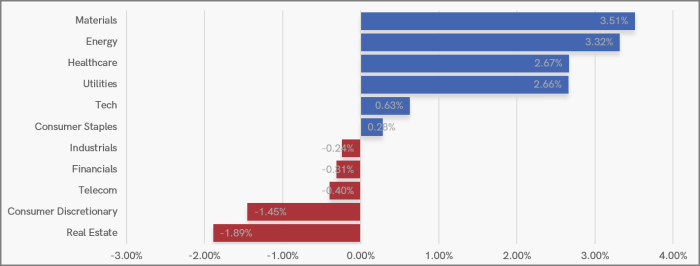

Materials and Energy led the way this week, extending their momentum as investors leaned back into commodities amid improving sentiment around global demand. Healthcare and Utilities also posted solid gains, adding a defensive tilt to the week’s winners, while Tech and Consumer Staples made smaller advances.

Further down the board, Industrials and Financials slipped slightly, while Consumer Discretionary and Real Estate came under more pressure. The pattern points to a market favouring hard assets and stability, with cyclical and rate-sensitive sectors taking a breather after recent strength.

UK Price Action

It’s been another week in which the FTSE has pushed to fresh highs, extending its powerful uptrend and reinforcing the bullish bias that’s dominated since mid-September. Trend and momentum remain firmly in favour of the bulls, with price continuing to respect the rising 50-day moving average.

There are, however, small signs of short-term exhaustion creeping in. A two-bar reversal pattern has formed near the recent highs, suggesting the index may be due a brief pause or pullback before the next leg higher. For now, the focus remains on how buyers respond if price dips back towards the 9,350–9,400 area which is a zone that should now act as support in this ongoing trend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.