22nd Oct 2025. 9.02am

Regency View:

Update

Regency View:

Update

Barclays upgrades guidance and launches £500m buyback

Barclays (BARC) delivered another solid quarter, achieving a return on tangible equity of 10.6% in Q3 and upgrading its 2025 target to above 11%. Profit before tax came in at £2.1 billion on income of £7.2 billion, up 9% year-on-year, with all divisions reporting double-digit returns. The bank also announced a £500 million share buyback and plans to move to quarterly buyback updates, signalling confidence in its capital generation and balance sheet strength.

Management highlighted strong income growth across Barclays UK and the Corporate Bank, both up over 15%, helped by the structural hedge and higher deposit margins. The Investment Bank posted an 8% income rise, driven by solid performances in Global Markets and Financing. Cost control continues to deliver results, with a year-to-date cost-to-income ratio of 59% and £500 million of targeted savings achieved a quarter ahead of schedule, even after absorbing a £235 million motor finance provision

For investors, the update confirmed Barclays’ steady progress towards its medium-term targets, including a RoTE above 12% by 2026 and at least £10 billion of capital returns over 2024–26. With a CET1 ratio of 14.1% and tangible net asset value now 392p, the bank is maintaining robust capital buffers while rewarding shareholders, reinforcing its position as one of the UK’s most reliable income and value plays in the sector.

BP steadies as refining margins strengthen

BP (BP.) issued a third-quarter trading statement indicating a broadly stable operational performance ahead of its full results in early November. The group expects upstream production to be higher than the prior quarter, supported by stronger gas output in its US bpx operations and increased activity in the gas and low carbon segment. Refining margins improved by an estimated $0.3 to $0.4 billion while turnaround activity eased, though oil trading was weaker and the Whiting refinery outage trimmed some of the benefit.

Overall, the update points to solid execution despite mixed market conditions. Brent averaged just above $69 per barrel through the quarter, up slightly on Q2, while Henry Hub gas prices softened. BP’s guidance suggests post-tax impairments of up to $0.5 billion, a modest level in the context of its diversified portfolio, and net debt is expected to remain broadly flat around $26 billion following planned hybrid bond redemptions.

Investors will take reassurance from BP’s steady leverage profile and improving downstream margins, even as trading conditions normalise from last year’s extremes. With results due on 4 November, attention will turn to cash flow and shareholder distributions, particularly after a year of mixed sentiment across the oil majors.

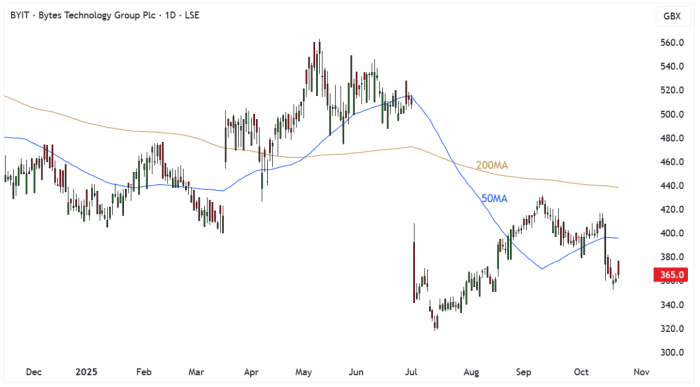

Bytes builds resilience amid changing incentives

Bytes Technology (BYIT) delivered half-year results showing modest top-line growth and solid customer retention despite a softer public sector backdrop. Gross invoiced income rose 9% to £1.34 billion and revenue increased 2.5% to £108 million, helped by strong demand for services, which grew more than 40%. Operating profit dipped 7% to £33.1 million as higher headcount and wage costs offset lower bonuses, and earnings per share slipped 5.1% to 12.03p.

The performance highlighted the impact of Microsoft’s partner incentive changes, which weighed on software margins, though management successfully transitioned clients to higher-value cloud solutions under the Cloud Solution Provider model. The balance sheet remains robust, with £82.3 million in cash and an interim dividend raised 3.2% to 3.2p per share, reflecting the company’s confidence in its long-term growth drivers across AI, security and cloud.

While profit margins have narrowed, Bytes continues to demonstrate consistency and customer loyalty across its base, with 98% of gross profit coming from repeat clients. As IT budgets stabilise, the business looks well placed to capture incremental demand from digital transformation and cybersecurity, areas where it has strong vendor partnerships and deep sector expertise.

HSBC faces scrutiny over Hang Seng bid

HSBC (HSBA) grabbed headlines this week with a $14 billion offer to buy the remaining 37% of Hong Kong’s Hang Seng Bank it does not already own. The move marks CEO Georges Elhedery’s first major strategic swing and drew a mixed reception from shareholders, who questioned the timing and valuation. The offer represents a 30% premium and would be funded by pausing share buybacks for three quarters while HSBC restores its capital ratio, a decision that unsettled some investors.

Elhedery argues that full control of Hang Seng will unlock synergies and provide access to an additional $3.2 billion of capital, but details on integration savings and revenue growth targets were limited. The two banks have operated closely for decades, and with Hang Seng’s real estate exposure under pressure after a 30% fall in Hong Kong property prices since 2021, investors are wary of hidden risks. Hang Seng’s non-performing loan ratio has risen sharply to 6.69%, largely driven by commercial property.

While the deal could eventually strengthen HSBC’s foothold in Asia and simplify its structure, the lack of transparency on cost synergies and credit risk has clouded sentiment. The valuation gap between buyer and target will take careful execution to justify, and the near-term pause in buybacks adds another headwind for investor confidence.

Morgan Advanced Materials under pressure as markets soften

Morgan Advanced Materials (MGAM) reported a mixed third-quarter update, with sales for the first nine months of 2025 down 3.6% year-on-year on an organic constant currency basis. The third quarter showed slight improvement, with revenue up 1.6%, suggesting stabilisation in several end markets. However, weakness persisted in the semiconductor segment as customers delayed orders into 2026, while European industrial demand became more uncertain.

Management now expects full-year sales to be around 4% lower than 2024, with adjusted operating profit margins slipping to roughly 10%. The weaker mix, currency headwinds and under-recovered costs from reduced volumes are weighing on profitability. That said, the company remains focused on cost discipline and simplification initiatives to offset the cyclical downturn and preserve cash flow.

For investors, Morgan’s latest guidance confirms a challenging near-term outlook but also underlines a prudent approach to capital management. The group’s long-term exposure to high-performance materials for energy and electronics gives it structural relevance, yet markets will likely wait for clearer signs of a demand recovery before re-rating the shares.

Mitie makes it look easy as guidance rises and buybacks return

Mitie (MTO) surged higher this week following an upbeat trading update that lifted full-year profit guidance and reignited share buybacks. The UK’s largest facilities management and compliance group now expects operating profit of at least £260 million for FY26, up from £234 million last year, supported by strong organic growth and an expanding contract pipeline. The announcement of a new £100 million buyback programme reinforced management’s confidence in the group’s balance sheet and operational momentum.

Revenue rose 10% to £2.7 billion in the first half, with 6.1% organic growth driven by contract wins, pricing gains and higher project volumes across defence, healthcare and local government. Around £3 billion of contracts were renewed or extended during the period, maintaining Mitie’s leading position in both public and private sectors. A record £31 billion pipeline of bidding opportunities provides visibility for the coming years, complemented by disciplined cost control and stable leverage near 1.0x.

The integration of Marlowe, acquired in August for £350 million, is progressing smoothly and expected to deliver £30 million of cost synergies by FY28. Strong cash generation and a clear strategy for growth and shareholder returns underpin the investment case, and the latest upgrade signals that Mitie’s transformation into a more profitable, cash generative business is gaining pace.

Whitbread feels the heat as costs bite and profits cool

Whitbread (WTB) saw its shares come under pressure after reporting a dip in profits and revenue for the first half of FY26. Adjusted pre-tax profit fell 7% to £316 million and revenue declined 2% to £1.54 billion, as softer food and beverage sales and rising cost inflation weighed on margins. Accommodation sales at Premier Inn UK remained broadly flat but continued to outperform the wider market, helping offset some of the pressure from its Accelerating Growth Plan restructuring.

Germany provided a relative bright spot, with total sales up 9% and losses narrowing to £3 million as the business edges closer to profitability. The acquisition of eight new hotels adding 1,500 rooms will strengthen its presence in key cities and support its goal of reaching £70 million adjusted profit before tax in Germany by FY30. Whitbread’s Five-Year Plan remains focused on expanding its room network to 98,000 in the UK and Ireland while improving efficiency and returns.

Despite the near-term drag from inflation and one-off restructuring costs, Whitbread reiterated its target to return £2 billion to shareholders through dividends and buybacks by FY30. The balance sheet remains robust, underpinned by a property estate valued between £5.5 billion and £6.4 billion, and management’s disciplined capital recycling provides scope for future reinvestment and income growth.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.